As the fallout from one of the biggest bankruptcies of 2019 begins to settle, we see that credit and procurement professionals who evaluate risk in public companies as a habitual practice are proving to be the best at avoiding unnecessary exposure.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor recently published a High Risk Report on pharmacy retail chain Rite Aid Corporation. This detailed report will provide five quick and important facts that you need to know about this financially weak drug store operator.

Sentiment data, farmed from leading credit managers who subscribe to our service, is pointing to extreme bankruptcy risk in a growing list of leading oil and gas giants.

CreditRiskMonitor offers up five quick and important facts that you need to know about Party City Holdco Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

The coronavirus has reduced air travel across key channels worldwide. Equity markets are souring on airliners, especially those that already carry excessive debt and are strapped for cash.

Credit professionals use CreditRiskMonitor®’s Trade Contributor Program to gain quality, real-time insights into their accounts receivable portfolio. We collect in excess of $2 trillion in trade data annually from our trade providers. After processing this data, we work with credit professionals to be more proactive and tactical with their accounts receivable to make healthier business decisions.

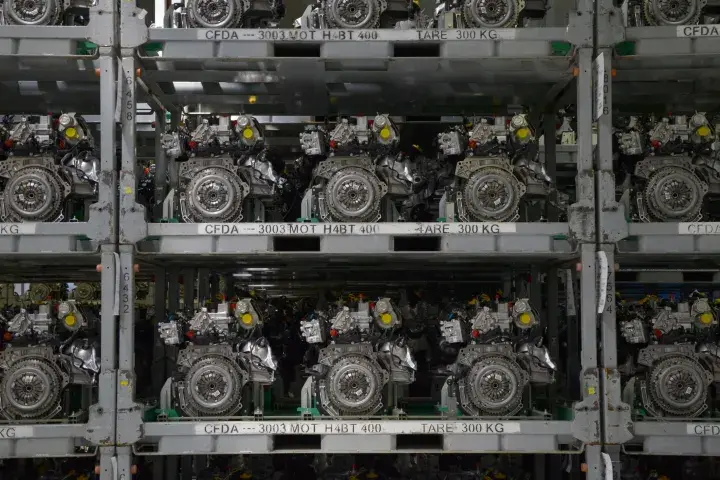

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

Solar panel demand in China is estimated to fall by approximately one-third in 2018, weakening the profitability of manufacturers and putting distressed operators like Yingli Green Energy Holding Company Limited in greater peril.

Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.