CreditRiskMonitor published a Bankruptcy Case Study on Party City Holdco Inc. ("Party City") on Jan. 17, 2023. The specialty retailer of party supplies and novelty items was walloped by both weak customer demand and an inadequate direct eCommerce experience relative to Amazon and similar online retailers. The business environment has improved, but the upturn wasn't strong enough to keep the company from seeking bankruptcy protection, a risk highlighted by the FRISK® score and examined in depth with our High Risk Report published on May 19, 2021. This article will provide five quick and vital facts about Party City that CreditRiskMonitor subscribers were warned about well in advance of the retailer's final collapse.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. Surprise Party? Not Exactly

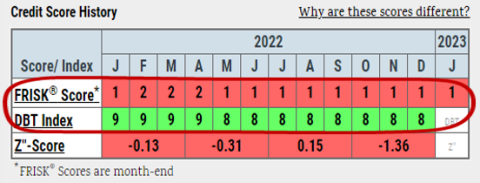

Party City's FRISK® score had been stuck in the lowest rungs of the "1" (highest risk)-to-"10" (lowest risk) range, what we call the FRISK® score "red zone", for more than a year before its bankruptcy filing. Since May 2021, a FRISK® score of "1" indicated a 10-to-50x higher risk of bankruptcy for Party City relative to that of the average public company. Therefore, CreditRiskMonitor subscribers were afforded ample time to adjust their credit terms just by looking at the FRISK® score:

However, the retailer continued to pay its bills promptly throughout this period, as indicated by its high Days Beyond Term (DBT) Index, a measure like Dun & Bradstreet’s PAYDEX® Score. This common pattern is known as the “cloaking effect”, which allows public companies to maintain access to low-cost trade credit. Risk professionals relying on payment history alone to assess risk at public counterparties are often surprised by bankruptcies.

The FRISK® score sees through the cloaking effect because payment history isn't a data component. Instead, the FRISK® score nonlinearly combines high-quality data inputs including financial statement ratios, credit agency ratings, stock market performance, and subscriber crowdsourcing. This insightful blend allows the FRISK® score to correctly categorize 96% of companies in the high-risk red zone at least three months prior to filing bankruptcy, or more in the case of Party City.

2. Bleeding Red Ink

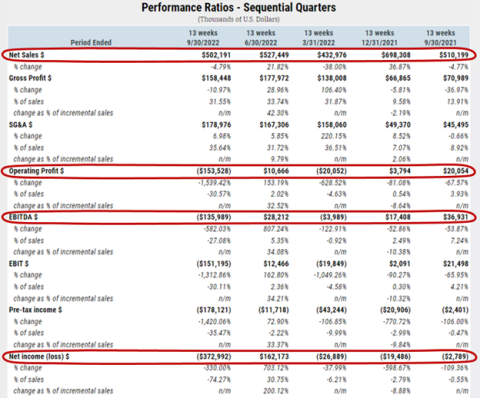

The most immediate cause of Party City's problems can be found in the top line. Sales fell precipitously in 2020 when social distancing was being used to help slow the spread of COVID-19. Simply put, people weren't going to parties or, in many cases, even leaving their homes, so buying party supplies was low down on the to-do list. The company's costs, by comparison, didn't decline in tandem with sales, so the bottom line became a disaster.

While sales improved in 2021, they didn't return to pre-pandemic levels. And as 2022 unfolded, inflation pressures negatively impacted sales and operating profit, and management continuously reduced its EBITDA guidance. After a disastrous third-quarter performance, the company ultimately decided it couldn't remain a going concern.

3. Heavy Weights

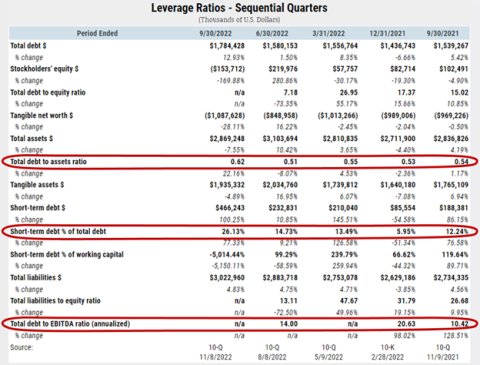

Companies with strong balance sheets can handle extended periods of adversity, but Party City's financial foundation was deteriorating fast. Notably, the company's debt-to-EBITDA ratio skyrocketed in 2020 and even after improving in 2021, it remained higher than its pre-pandemic level. Weak operating performance in 2022 pushed this ratio into double-digits while total debt-to-assets ran above 50%, landing Party City in the bottom quartile of its industry peers.

The last five quarters also indicated the company relied on short-term financing to support its working capital needs amid ongoing losses and negative free cash flow.

4. A Spooky Zombie Lurked Menacingly

The combination of a heavy debt load, with an increasing reliance on short-term debt, and weak operating performance resulted in Party City being unable to adequately cover its interest costs. Companies in this situation are often called "zombies" because their lenders' largess is the only factor keeping them alive.

This was not a new situation for Party City, which had negative interest coverage in 2019 and 2020. It was able to cover interest expenses in 2021, but as 2022 unfolded, its business struggles intensified. Adding in the rising interest rate environment, the retailer’s debt servicing quickly deteriorated and eventually lenders must be paid.

5. Liquidity and Loss

Another common feature of zombie companies is operating with a fragile liquidity position. Subscribers can access the liquidity ratios report page to analyze cash availability and liquid assets available to run the business. Party City’s cash balance steadily eroded from $70.7 million to $29.8 million in the last five fiscal quarters. Additionally, its five quarter average cash and quick ratios were persistently weak at 0.06 and 0.19, respectively. That’s a particularly dangerous combination when interest coverage ratios are inadequate and monetizable current assets are limited for servicing interest payments.

When compared against miscellaneous retail (SIC 59) industry peers, its liquidity ratios also ranked in the bottom quartile of industry peers. Generally, companies that fall into this category have difficulty deleveraging and are most vulnerable to tripping into bankruptcy.

Bottom Line

Party City's decline into bankruptcy followed a fairly predictable path, where the FRISK® score identified high risk despite prompt payment behavior. Beyond the FRISK® score, subscribers received timely news alerts and reviewed deteriorating financial results, among other research patterns, that enabled them to adjust risk exposure. Most of all, Party City represents just one retail bankruptcy, but many others are vulnerable to failure in 2023. Contact CreditRiskMonitor to see how we can help you identify your riskiest counterparties before they impact your portfolio.