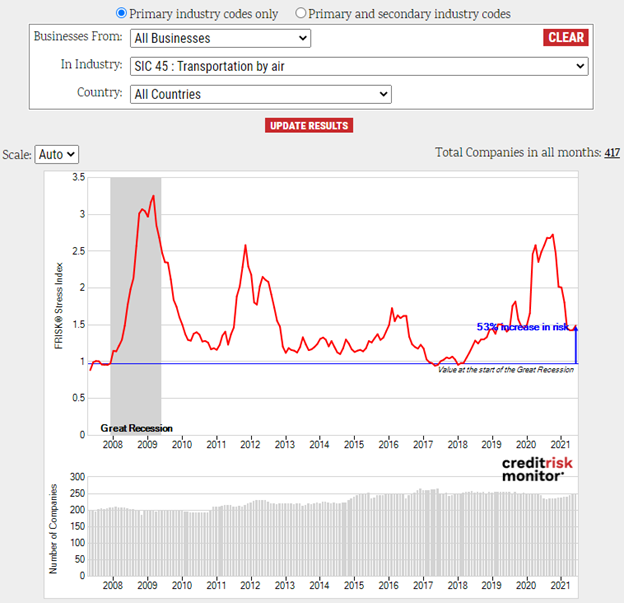

Governments have restricted air travel to mitigate the spread of the coronavirus (COVID-19) and businesses and individuals have decided to postpone flying, causing airliners to lose billions in sales revenue during the first quarter of 2020. Executives are even preparing for flight disruptions to last through the summer. The FRISK® Stress Index for the air transportation industry surged in 2020, with more than 65% of companies being categorized as high risk. The index compares the probability of failure across a group of companies (such as an industry, a country or a user’s portfolio) from 2007-to-present.

Aggregate financial risk for the industry has increased by 123% since 2007, where four operators based out of Europe and Asia-Pacific are now on bankruptcy watch.

International Air Transportation Association’s CEO, Alexandre de Juniac, addressed the sensitivities of the current downturn:

“The turn of events as a result of COVID-19 is almost without precedent…It is unclear how the virus will develop, but whether we see the impact contained to a few markets and a $63 billion revenue loss, or a broader impact leading to a $113 billion loss of revenue, this is a crisis.”

Due to subdued air traffic, international airliner Flybe Limited entered administration on March 3, after the U.K. government rejected providing the company a £100 million bridge loan to stay afloat. Unfortunately, more failures may be on the way.

FRISK® Score Downgrades

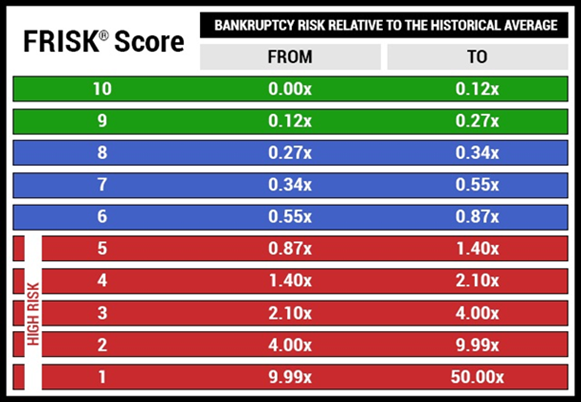

Distinct from the FRISK® Stress Index, CreditRiskMonitor’s 96% accurate FRISK® score assesses bankruptcy risk in public companies over a subsequent 12-month period. The FRISK® score is based on a “1” (worst) to “10” (best) scale, with any score equal to “5” or less in the high-risk red zone (see below).

With heavy fixed cost structures and large losses of traffic, airliners with poor liquidity profiles may collapse over the course of 2020. Whether acting as a trade creditor or aircraft lessor, you need to immediately adjust exposure to these four specific carriers.

Thai Airways International PCL has reported net losses in six of the last seven reporting periods. In March, management announced that travel advisories related to the coronavirus would negatively impact flights and traffic production. The company’s FRISK® score was recently downgraded from “2” to “1,” indicating a 10x-50x greater risk of bankruptcy versus the average public company. This bottom-rung rating is derived from poor financial statement ratios, including its negative operating margins and high leverage. Additionally, the company’s market capitalization has steeply declined and total liabilities exceed market capitalization by 25x, indicating substantial concern from equity markets.

Virgin Australia Holdings Ltd has been financially stressed over the last few years. On Feb. 25, the company reported results for the fiscal period ended Dec. 31, 2019, marking the seventh net loss for the business out of the last eight semi-annual periods. The company’s total debt balance also increased as it took on unsecured debt and pushed leverage (total liabilities to total assets) to a record 123%. Management detailed that they would be restructuring operations in response to the COVID-19 outbreak by: “reducing its fleet as well as planning fewer flights amid cancellations on international and domestic routes due to the coronavirus.” The company’s FRISK® score dropped to an all-time low of “1,” again indicating a 10x-50x probability of bankruptcy compared to the average public company:

Sweden-based SAS AB also reported its fiscal period ended Jan. 31, 2020 results with a net loss that nearly doubled year over year. Excluding the IFRS 16 operating lease transition, the company issued about 4.2 billion Swedish Krona in debt financing and net leverage increased to a record 92%. In response to the coronavirus, Chief Executive Officer Richard Gustafson stated that flights have been suspended to China and Hong Kong, 2020 guidance would need to be withdrawn, and significant cost reductions would be required. The company’s FRISK® score declined to a fresh low of “1,” which is well below the airline industry’s average of “5.”

Malaysian-based AirAsia X Bhd also has meaningful exposure to the coronavirus. According to Reuters, management had to delay the delivery of 78 Airbus planes and consider reducing the size of its overall fleet. After reporting net losses for two consecutive years, the coronavirus headwind is creating additional pressure. Furthermore, total debt comprised about 97% of the total capital structure, leaving little financial flexibility. The company’s FRISK® score was downgraded from “2” to “1,” following a spike in stock price volatility and a deterioration in its total liabilities-to-market capitalization, now trending at approximately 23x.

Bottom Line

The coronavirus has reduced air travel across key channels worldwide throughout the first quarter and could disrupt at least the entire first half of 2020. Equity markets are souring on airliners, especially those that already carry excessive debt and are strapped for cash. At least four airliners have seen their FRISK® scores downgraded to a “1,” indicating that each has a severe risk of corporate failure over the next year. Nearly 40% of the Fortune 1000 rely on CreditRiskMonitor to stay ahead of bankruptcy, and you should too. Don’t wait for a counterparty bankruptcy to blow up your portfolio, contact us today for a free risk assessment.