North American oil and gas, already facing oversupplied markets, has been leveled once more: this time, by coronavirus-induced demand weakness and the price war between OPEC and Russia. Without a price recovery in 2020, exploration and production (“E&P”) companies will have difficulty accessing external funding, raising cash by selling assets, and may burn through whatever liquidity they have.

Counterparties must immediately identify which E&Ps are the least likely to survive the current energy market rout, lest they leave themselves with an inordinate amount of exposure and potentially titanic write-downs. The easiest way to align your portfolio against such consequence is by considering the CreditRiskMonitor FRISK® score.

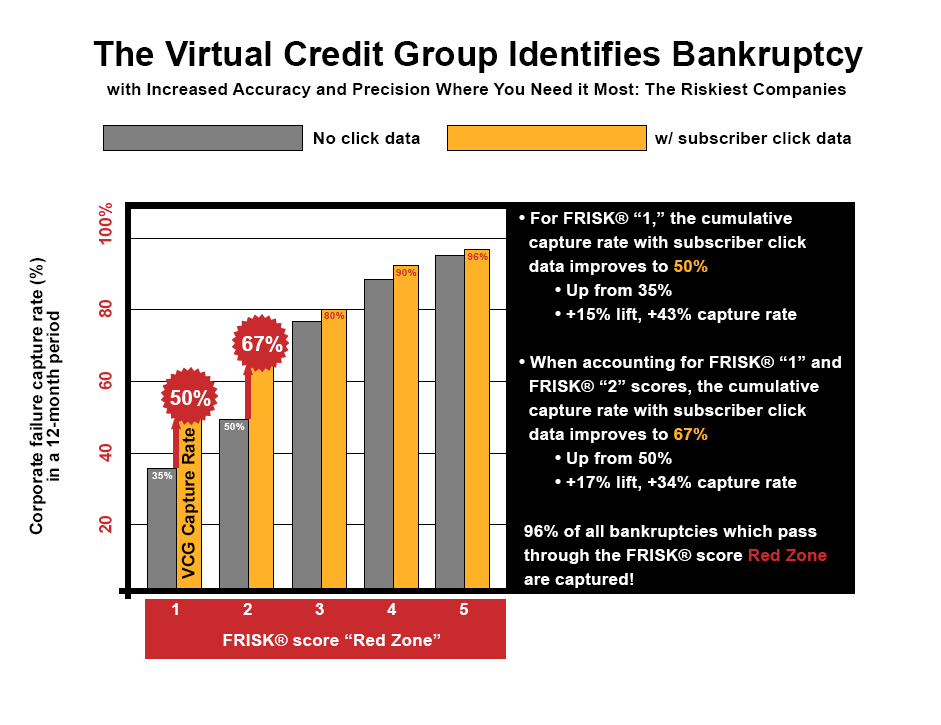

The FRISK® score predicts bankruptcy with a 96% rate of accuracy over a subsequent 12-month period. The model leverages diverse data components, including stock market performance, financial statement ratios, bond agency ratings, and proprietary subscriber crowdsourcing data. With two decades of cumulative data at hand, we’ve found that research patterns on CreditRiskMonitor by our subscriber base – senior risk officers from nearly 40% of the Fortune 1000 – identifies financial distress in the months leading up to a bankruptcy filing. These professionals, known as the Virtual Credit Group, are flashing warning signs for certain E&Ps.

Credit professionals, like the ones that use our service, have access to non-public information and are not subject to Fair Disclosure regulation. As a company appears increasingly risky, this group will research and examine the entity more thoroughly. For example, an analyst might review the following trends for an E&P:

- Financial leverage

- Production costs

- Maintenance and growth capex

- Outstanding hedging contracts

- Asset impairment charges

- Availability on credit revolvers

- Borrowing rates

- Headroom on covenants

Crowdsourcing determines if, in aggregate, such research is normal behavior or indicative of concern. The unique crowdsourcing component has been proven to improve the timeliness and accuracy of the FRISK® score prediction. The chart below demonstrates how crowdsourcing data has improved the capture rate (successfully predicting bankruptcy) in the highest risk categories compared to the original model:

In April 2020, 10 oil and gas companies have seen an increase in concerned research behavior patterns by our subscribers. Importantly, each has received a FRISK® score determination of “1” or “2” – indicating 4x to 50x higher risk of bankruptcy versus the average public company.

A Bankruptcy Exposed Among them was Whiting Petroleum Corporation, which filed Chapter 11 on Apr. 1 in the U.S. Bankruptcy Court for the Southern District of Texas. Its 10 largest unsecured trade creditors, including oil equipment services providers and midstream pipeline operators, had more than $35 million in exposure according to the bankruptcy petition. Risk professionals may have missed the severity of the risk here given management stated in pre-bankruptcy MD&A disclosures that, “we believe that we have sufficient liquidity and capital resources to execute our business plan over the next twelve months and for the foreseeable future.” Whiting Petroleum concurrently carried more than $4 billion in tangible net worth exceeding all of its outstanding liabilities of $3.6 billion in the fourth quarter. Despite these facts, the FRISK® score identified the underlying bankruptcy risk and provided an adequate warning signal. It revealed extreme financial distress, with subscriber crowdsourcing pushing the score down from a “2” to a “1,” for seven months prior to the filing, as shown below:

Crowdsourcing Risk Perspectives

Although its downfall made headlines, bankrupt Whiting Petroleum was not the only operator that had its FRISK® score deteriorate over the past year. Below are 10 U.S. and Canadian E&Ps that have carried lower-tier FRISK® scores, in part fueled by the negative assessments of subscriber crowdsourcing:

Company | FRISK® Score | Subscriber Crowdsourcing |

Crew Energy Inc. | 1 | Negative |

Ultra Petroleum Corporation | 1 | Negative |

Whiting Petroleum Corporation | 1 | Negative |

California Resources Corporation | 1 | Negative |

Chesapeake Energy Corporation | 1 | Negative |

Gulfport Energy Corporation | 1 | Negative |

Kosmos Energy Ltd. | 1 | Negative |

Perpetual Energy Inc. | 1 | Negative |

Delphi Energy Corporation | 1 | Negative |

Obsidian Energy Ltd. | 2 | Negative |

Centrus Energy Corporation | 2 | Negative |

CreditRiskMonitor subscribers are collectively providing a warning on these distressed operators. Should energy prices remain low throughout 2020, E&Ps will need to curtail production as price hedges roll off. In many cases, cash flow will be unable to service debt. Be sure to examine corporate balance sheets, especially from a leverage and liquidity perspective, as well as the peer analysis tool.

We’ve already seen plenty of evidence that E&Ps are taking aggressive steps to stave off financial trouble, including Chesapeake Energy Corporation engaging in distressed debt exchanges, California Resources Corporation seeking an out-of-court restructuring, and Ultra Petroleum Corporation seeking a potential restructuring deal, among other seemingly desperate moves within the sector.

Bottom Line

CreditRiskMonitor provides commercial credit report coverage on more than 2,000 oil and gas companies worldwide – and the FRISK® score provides the most timely and accurate risk assessments in the marketplace. These attributes are enhanced by subscriber crowdsourcing as the model harnesses the perspectives of numerous, seasoned risk professionals. If their aggregated research behavior reflects concern, chances are the company could be headed for bankruptcy, even if it doesn’t seem apparent at first. Contact us today if you would like to discuss your risk in the E&P industry or any one of the 10 companies highlighted above.