Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The coronavirus has reduced air travel across key channels worldwide. Equity markets are souring on airliners, especially those that already carry excessive debt and are strapped for cash.

A recent IMF report has highlighted a surge in instability within nonfinancial corporations. As the potential for mass economic failure mounts, CreditRiskMonitor is providing the daily markers that effectively signal on the counterparties in your portfolio that hold the most extreme bankruptcy risk potential.

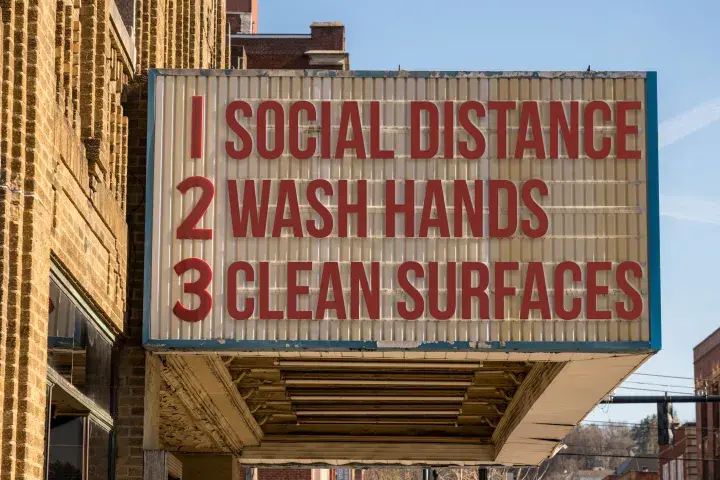

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

Establishing a culture of strong supply chain oversight is vital during a global pandemic, and CreditRiskMonitor can provide you all the tools necessary to be successful in this endeavor.

The global effort to slow the spread of COVID-19 continues to impact all economic regions and industries. Risk professionals must adapt quickly or risk being sideswiped by the rise in bankruptcies.

CreditRiskMonitor offers up five quick and important facts that you need to know about Peabody Energy Corporation right now to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

More than one full year into restrictive stay-at-home orders across the globe and with vaccinations being administered slowly, there are no guarantees that air travel will experience a full rebound anytime soon.

The COVID-19 pandemic swiftly delivered hundreds of bankruptcy filings in 2020. Here in 2022, geopolitical tensions, supply chain challenges, and tightening credit conditions could lead to a similar devastating outcome.