Following recent banking turmoil, tighter financial conditions, and buildup in vulnerabilities, the International Monetary Fund (IMF) warned in April 2023 that “financial stability risks have risen significantly.” While future bank failures remain unknowable, nonfinancial corporations are challenged with excessive debt obligations, higher interest rates, and diminishing financial buffers.

CreditRiskMonitor’s FRISK® Stress Indexes have tremendously deteriorated, which indicates the threat of future bankruptcy filings and corporate failures continues to build.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

The Global Picture

The IMF’s Global Financial Stability Report addressed the global corporate sector’s ability to manage higher interest rates and a slowing economy. The organization then outlined that multiple fundamental factors could simultaneously break down:

“The resilience of the sector has yet to be fully tested. Corporations emerged from the pandemic with much higher debt loads. The ability to service this debt could weaken in a higher-for-longer environment as interest rates lead to higher borrowing costs, weaker aggregate demand, and more stringent bank lending standards. In addition, some companies may find it difficult to pass higher input costs along to customers.”

Within the report’s corporate performance and default outlook, the IMF also outlined several risk factors that have already transpired, which CreditRiskMonitor believes are especially noteworthy:

- Global corporate profitability has likely peaked, and is expected to slow down

- Liquidity buffers have been eroded relatively quickly

- Emerging markets foreign currency debt-to-GDP ratios remain elevated, which could expose corporations to large currency depreciation and even weaker interest coverage ratios

These cumulative issues set the stage for a challenging corporate outlook. According to the Bank for International Settlements, nonfinancial corporations carry approximately $85 trillion in total credit compared to $45 trillion in 2009, nearly double the amount of debt outstanding. Within this mountain of credit exists a group of zombie companies, which CreditRiskMonitor estimates to be approximately one-third of companies globally.

Major FRISK® Stress Index Trends

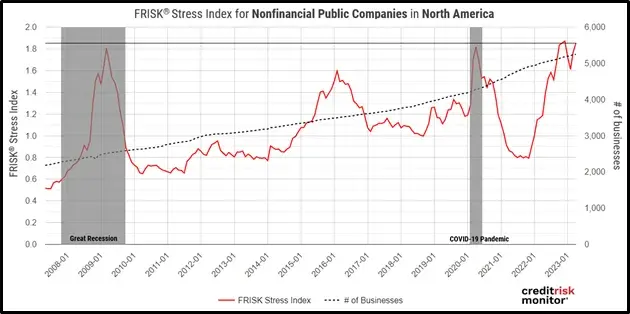

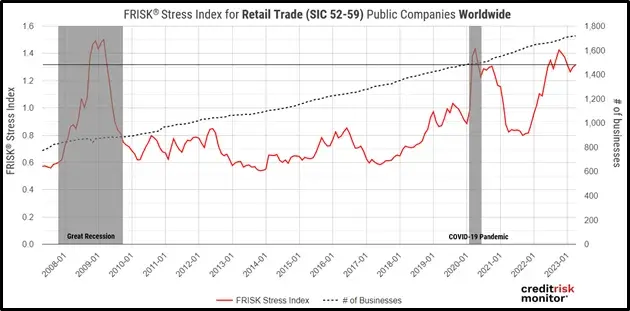

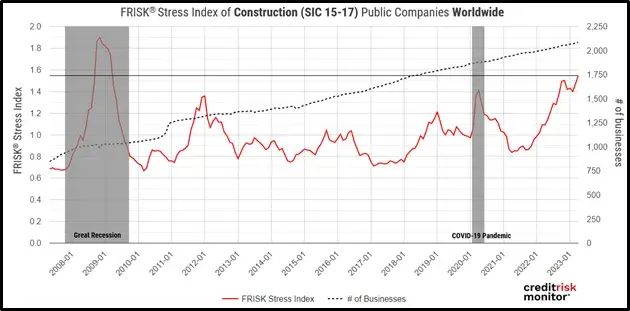

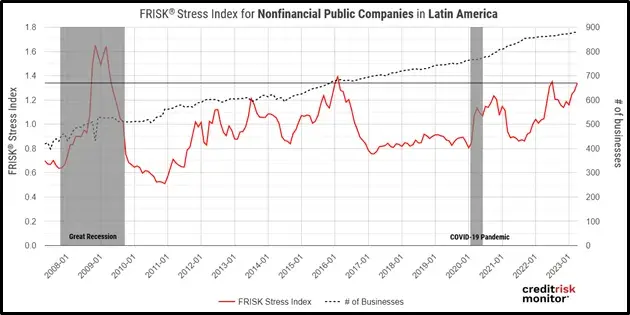

As part of our regular reviews of corporate financial trends, CreditRiskMonitor evaluated businesses globally with the daily-updated FRISK® Stress Index. The FRISK® Stress Index shows the collective probability of failure in a group of companies (such as an industry, country, or portfolio) over the next 12 months. For more than 15 years (and counting), CreditRiskMonitor has leveraged this index to identify multiple high-risk levels and trends developing across geographies, sectors, and industries. In these charts, the FRISK® Stress Index has already reached or exceeded levels of past economic downturns, including the Great Recession and COVID-19 Pandemic. This development should be top of mind for risk professionals, especially given that a recession has yet to be officially announced.

In North America, the FRISK® Stress Index has already approached peak levels exhibited in the Great Recession and COVID-19 Pandemic. Multiple underlying sectors and industries, including the manufacturing sector, are the primary cause of this trend. Cyclical industries are the most economically sensitive and usually, the first areas to deteriorate.

Another cyclical sector – broadly assessed when viewing worldwide – is retail trade, which also shows significant financial stress. Although still below record levels, the dramatic uptrend over the last 18 months suggests retailers are under pressure. Retail sales are usually viewed as a leading indicator for the economy.

Another highly cyclical sector is construction, which has exhibited a major risk uptrend over the last 18 months. Among the largest contributing factors are the real estate challenges in the Asia-Pacific Region, particularly China, which entered into a depression in late 2022 with ongoing developer defaults and failures.

Another vulnerable area includes nonfinancial corporates in Latin America, which are exposed to currency shocks. According to the IMF’s report, more than 10% of corporate borrowings are denominated in a foreign currency, nearly twice the overall level of emerging markets. With Latin America’s financial stress already approaching multi-year highs, currency volatility could deliver incremental financial pressure.

Other FRISK® Stress Index views also demonstrate vast accumulations of company financial risk across geographies and industries. These visualizations and data insights can be accessed on CreditRiskMonitor and SupplyChainMonitor. Overall, subscribers leverage the FRISK® Stress Index in the following ways:

- Identify aggregated financial risk trends and levels by industry, country, and portfolio

- Reveal otherwise hidden risks detected by artificial intelligence and machine learning

- Compare to private companies when risk scores and ratings are unavailable

- Integrate via API into third-party software for more efficient workflows

Bottom Line

As corporate financial stress continues to build, CreditRiskMonitor strongly cautions risk professionals to keep their eyes wide open and proactively monitor their high-risk counterparties. When the economy enters another downturn, these trends always worsen and accelerate corporate failure rates. It’s best practice to be sufficiently prepared for when the tide finally goes out. Contact CreditRiskMonitor for more information about how to improve risk management procedures and monitor your portfolio with precision.