CreditRiskMonitor offers up five quick and important facts that you needed to know about now-bankrupt Yellow Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

When the FRISK® score becomes your go-to metric for financial risk analysis, incredibly accurate (read: good) adjustments follow.

While risk analysis professionals may be tempted to use the statistical FRISK® score as a component within a different model, such as one that is rules-based, doing so may generate suboptimal results.

Sears Holdings Corporation has closed underperforming stores and cut costs, yet a hedge fund controlled by company CEO Eddie Lampert is now pushing for even more forceful financial restructuring to stave off bankruptcy.

Knowledge of how and when to react to a business defaulting is essential; cutting ties with a customer or supplier too soon could lead to a missed sales opportunity, while being too late can result in financial loss.

Pier 1 Imports, Inc.'s management is hyper-focused on turning around the business, but don’t let other scoring methods (including the PAYDEX® score) mislead you.

The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.

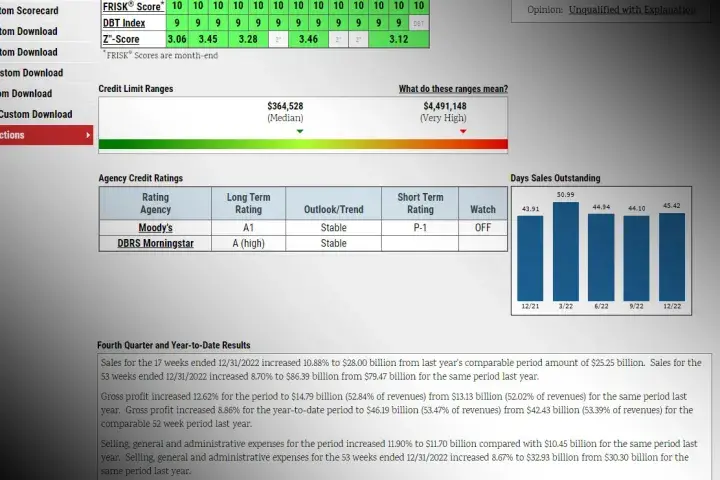

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.