Commercial defaults and bankruptcy filings are rising in 2023. CreditRiskMonitor accurately predicted the three largest bankruptcies year-to-date of Avaya Holding Corporation, Party City Holdco Inc., and Simmons Bedding Company, LLC. In preparation for future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring of the size of credit lines. This article outlines how the solution helps subscribers optimize their receivables exposure by account.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

Important Credit Decision Factors

Credit professionals provide trade credit lines to their customers to obtain and retain more business. Terms are generally straightforward for financially healthy accounts; however, riskier customers require detailed reviews and careful judgment. In CreditRiskMonitor business reports, subscribers have access to the company’s Credit Score History and Credit Limit Ranges to make more informed decisions.

The Credit Score History features CreditRiskMonitor’s industry-leading bankruptcy prediction scores, including the 96%-accurate FRISK® score and 80%-accurate PAYCE® score, for public and private companies, respectively. Both scores use a similar bankruptcy scale of "1" (highest risk)-to-"10" (lowest risk), where “5” or lower represents the high-risk “red zone,” indicating above-average bankruptcy risk.

- The company’s bankruptcy risk score (i.e., FRISK® score, PAYCE® score, etc.) must be considered for the requested credit limit. Account review procedures will inevitably vary between subscribers, however, CreditRiskMonitor provides these broad guidelines:

- FRISK®/PAYCE® of “9” and “10” (low risk) can bypass review and may receive automatic approval

- FRISK®/PAYCE® between “6” and “8” (medium risk) should be reviewed periodically

- FRISK®/PAYCE® between “3” and “5” (high risk) requires monthly monitoring and review

- FRISK®/PAYCE® of “1” and “2” (highest risk) requires immediate attention and potential credit adjustment

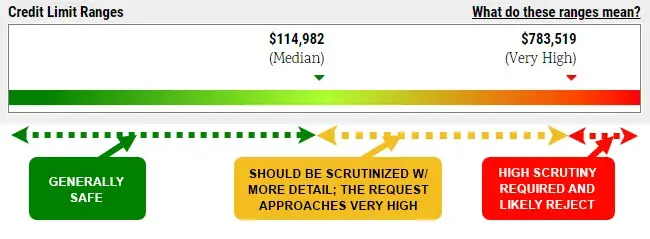

- The Credit Limit Ranges solution helps assess a requested credit limit value against a distribution of other existing credit limits provided to similar businesses. The distribution of relevant credit limits is calculated by using all reported high credits for the subject business and similar businesses in the past 12 months. Similar businesses are determined based on industry type, company size, and risk level – if the subject company’s risk score changes, then the Credit Limit Ranges will adjust accordingly. The Credit Limit Ranges can be categorized into three groups, including:

- Equivalent or less than the median amount (generally safe for credit extension)

- Between the median and very high amount (acceptable, but review required)

- Very high amount and above (high scrutiny required, possibly reject)

According to Dr. Camilo Gomez, CreditRiskMonitor’s SVP of Data Science, there are multiples ways to establish credit limits, but as a general practice, credit professionals can consider the following:

“A credit limit below the median value indicates that most credit lines are larger than the amount considered. If the risk score indicates low risk, then the considered amount is a safe limit. A credit limit near the very high value indicates that most credit lines extended are well below the considered amount, which suggests more due diligence is needed.”

Every company has their own unique processes, but all subscribers can benefit from this overall approach to mitigate receivable risk exposure while still growing sales.

Real-Time Actionable Insights

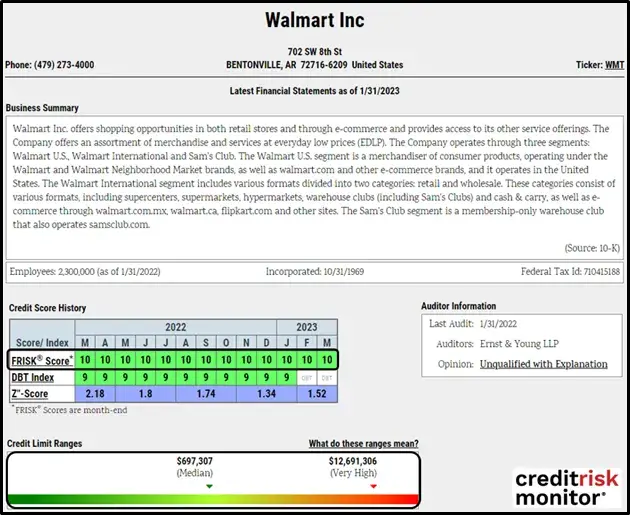

In the ideal scenario, a company reports a consistent FRISK®/PAYCE® score of “10,” the best ranking. With minimal bankruptcy risk, credit professionals should consider all values on the Credit Limit Ranges. In the example below, Walmart Inc.’s FRISK® score of “10” demonstrates pristine financial health and a strong likelihood of repayment. The Credit Limit Ranges median value is categorically safe; however, credit professionals may extend to the very high amount to maximize sales with a financially strong customer.

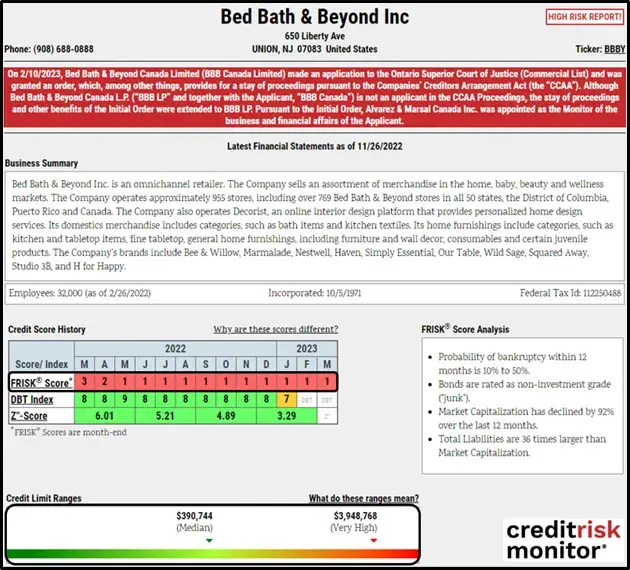

Moving further down the bankruptcy risk scale are medium and high-risk companies that require attention. Companies with red zone FRISK® and PAYCE® scores require the most thorough and frequent reviews. Any company in the red zone will display a FRISK® or PAYCE® Score Analysis to summarize key factors. The FRISK® score’s worst ranking of “1” indicates a 10-to-50% probability of bankruptcy over the next 12 months. In the example with Bed Bath & Beyond Inc.’s FRISK® score of “1,” credit professionals should also avoid the very high credit limit and remain closer to the median or a lower amount.

Demystifying Uncertain Accounts and Risk Mitigation

The Credit Limit Ranges solution provides a unique advantage to subscribers for private companies and small and medium enterprises (SMEs). Private companies naturally have less available information than public companies and SMEs can have less stable financial positions relative to large companies.

Dr. Gomez explains that Credit Limit Ranges provide credit professionals with a better frame of reference:

“The Credit Limit Ranges work well for all public companies, but are especially beneficial for private businesses and SMEs where the credit risk profile is less transparent. Quantifying the credit limit in these cases provides additional guidance for credit professionals.”

Companies without a FRISK® or PAYCE® score can have Credit Limit Ranges available as well by using data provided by similar businesses. Although inherently less reliable than a company with their own risk score, credit professionals can factor the Credit Limit Ranges into their decision making.

The credit limit is only one of the multiple strategies to mitigate risk exposure with an account. Depending on the FRISK®/PAYCE® score's level and trend, credit professionals should incentivize customer behavior with other aspects of their credit policies, such as:

- Higher/lower discounts for early payment

- Higher/lower late penalties

- Longer/short payment terms

- Cash on delivery or cash in advance

Different methods of payment in international trade ranked among the most to least secure include: cash in advance, letter of credit, documentary collection or draft, open account, and consignment, which are detailed by the International Trade Administration. Otherwise, trade credit insurance can be valuable for high-risk accounts if the policy is not too expensive.

Bottom Line

The Credit Limit Ranges solution combined with AI-driven bankruptcy prediction scores are powerful analytical tools. Credit professionals can improve their workflows by setting up auto-approvals for low-risk accounts and prioritizing high-risk for review and policy adjustments. As bankruptcies accelerate in the years ahead, primarily due to excessive corporate debt and higher interest rates, credit professionals can save their company bottom lines by playing defense with receivables.

To upgrade your credit culture even further, learn how you can join our Trade Contributor Program and read our latest research on zombie companies globally.