Fifteen years of time, money, data compiling and backtesting has brought CreditRiskMonitor’s FRISK® score to a 96% accuracy threshold in predicting financial risk in U.S. public companies. While risk analysis professionals may be tempted to use the statistical FRISK® score as an input component for a different model, such as one that is rules-based, doing so will generate suboptimal results. CreditRiskMonitor recommends that subscribers use the output of the FRISK® score as a standalone risk identifier, and/or as a confirmation indicator against your own models or internal scorecards.

Destruction by Dilution

The CreditRiskMonitor FRISK® score uses a variety of historical and real-time datasets. The four primary data components of the proprietary score are: stock market metrics, bond agency ratings, financial statement ratios, and our own crowdsourced sentiment measurement of risk professionals who use our service. If a model developer or an analyst were to configure a separate model – one which integrates the FRISK® score with other information – will underperform regardless of optimization. New data that is meant to complement the FRISK® score likely already exists within the model.

Without the actual factors at hand, there could be overlapping data inputs. In general, double counting information in any financial model will lead to an inaccurate result. The same would be true if data inputs, such as financial statement ratios, were inappropriately weighted. Any miscalculation, even if it’s just one factor within a model, will have a material impact on the validity of the risk prediction.

Less accurate data could mislead your company on an important business decision, which is the last thing needed inside a credit or procurement department. Just one missed public company bankruptcy can lead to steep financial losses and major headaches for your company. Adding your own “ingredients” to the FRISK® score to create a homebrew metric may sound like an interesting idea, but such an adjustment will dilute what is a timely and precise model.

Already Optimized

The creator of the FRISK® score, CreditRiskMonitor Sr. Vice President of Quantitative Analytics Dr. Camilo Gomez, wrote a 12-page white paper that describes the purpose and design of the model. Within the analysis, he describes the primary benefit of having more information versus less:

“A number of models combine multiple sources of information (e.g., the FRISK® score) to produce an overall credit score that improves on the shortcomings of any one approach.”

Essentially, the FRISK® score is already a multi-factor system: the data inputs are inherently comprehensive and every component is dynamically weighted in a non-linear fashion to measure risk in a diverse range of scenarios. For non-linear relationships, consider a corporation’s liquidity position. If a given company’s net cash position were to decline from $50 billion to $45 billion, the incremental credit impact is negligible. However, if a business were to swing from a working capital surplus to a deficit, all else being equal, the impact is much more pronounced and dramatically affects sustainability. Equally significant, the FRISK® score has also been rigorously backtested through a full business cycle – not just a few short years.

The statistical evaluation method used to measure the accuracy performance of the FRISK® score and the majority of statistic models is the “Receiver Operating Characteristics” (ROC) curve. If new ratios or other data are indiscriminately combined with the FRISK® score, it would dilute the performance achieved through extensive backtesting. The net effect could reduce the true positive rate (TPR), or the 96% accuracy rate that CreditRiskMonitor achieves every year. Otherwise, if the TPR were to shift higher, the false positive rate would likely degrade and thus falsely identify more businesses as feasible bankruptcy candidates. Either case would be an inconvenience for users.

As an example, see the graph shown below. The ROC curve displays results for the FRISK® score by itself, the Z"-Score (which use financial ratios only), and a 50-50 mix of the two scores. Notably, the mixed score underperforms the standalone FRISK® score.

Explaining the Solution

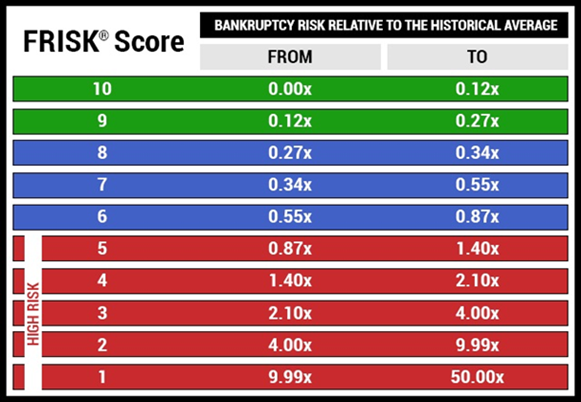

Regarding the actual use of the FRISK® score – it is based on a “1” (worst) to “10” (best) scale with different tiers of financial stress and bankruptcy risk for public companies. When the score falls into the bottom half (“1” to “5”) of the scale, known as the FRISK® “red zone,” a company is at elevated risk of bankruptcy. See the FRISK® chart below:

Currently, 96% of U.S. public companies that eventually file for bankruptcy are in the red zone for one year – or slightly longer – prior to their bankruptcy declaration, as implied by the bankruptcy probabilities. CreditRiskMonitor subscribers are continually made aware when companies in their portfolio are in the red zone. Subscribers are advised to carefully review these companies’ financial statements as well as pertinent news that we provide on a regular basis.

The FRISK® score should be compared with your internal scoring system and ratings if you have them. Agreement between the FRISK® score and your internal systems can provide confirmation of a company's financial strength or weakness. Disagreements would suggest that more examination is necessary. If your findings ultimately result in concern, it may be time to have discussions with the company’s management team and possibly take action to mitigate risk exposure.

Bottom Line

The FRISK® score is a powerful tool that has been thoroughly optimized for credit and procurement professionals. The 96% accurate model identifies financial risk with a 12-month time horizon and subscribers are promptly alerted when a company is trending in the FRISK® red zone. The model uses vast arrays of data and is calibrated in a unique manner unlike traditional credit models. It is meant to be a standalone solution, while other models and forms of analysis should be processed separately. If you would like to discuss this issue in greater depth, please contact your dedicated Account Manager or Sales Executive.