CreditRiskMonitor’s integration of subscriber crowdsourcing into the FRISK® score continues to prove itself as a unique enhancement, unavailable in any other bankruptcy prediction model. Recently, the "Virtual Credit Group" highlighted the elevated risk of coal miners Peabody Energy Corporation and Alpha Metallurgical Resources Inc.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Bankruptcy filings are dramatically increasing in 2023; several large Chapter 11s have been accurately predicted already with the aid of our exclusive crowdsourcing data input, made available only to CreditRiskMonitor subscribers.

Crowdsourcing finds that hundreds of oil & gas companies continue to deal with financial distress in spite of the stabilization of energy commodity prices.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how credit manager crowdsourcing play a role.

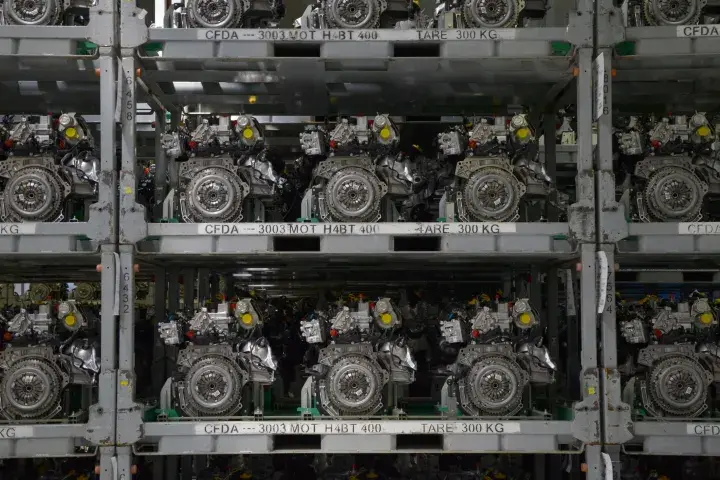

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

Sentiment data, farmed from leading credit managers who subscribe to our service, is pointing to extreme bankruptcy risk in a growing list of leading oil and gas giants.

For J. C. Penney Company, Inc., CreditRiskMonitor's proprietary subscriber crowdsourcing is indicating negative sentiment and matches the high-risk assessment of the retail giant provided by the FRISK® score.

The "Virtual Credit Group" is giving unfavorable reviews for AMC Entertainment Holdings and Cineworld Group, two of the largest - and riskiest - movie theater chains in the world.

Stage Stores Inc. is nearly 10 times more likely to face bankruptcy by this time next summer than the typical public company.