This is the fourth part of our in-depth look at the components of our proprietary FRISK® score, a dynamic, mathematically-driven solution which has proven 96% accurate in predicting U.S. public company bankruptcy risk during a 12-month period. Click on the links to read Part 1: The Wisdom of the Markets, Part 2: Financial Ratios and Part 3: Bond Agency Ratings.

CreditRiskMonitor’s subscriber website is strategically structured so that usage data can be tracked and analyzed. When credit managers access the database, they’re first brought to a snapshot screen which provides top-level company information for a quick checkup. Most of the time, someone looking at companies which have a moderate-to-high FRISK® score will only need to view this snapshot page to obtain the information – and peace of mind – they require.

Yet risk is out there, and the CreditRiskMonitor service methodically proves that not every company in your portfolio will be in solid financial standing. With these situations in mind, our subscriber site offers the ability to drill down into in-depth financial information to detect risk: such as financial ratios, stock market data, news updates and annual reports.

Obtaining financial insight, prior to actual disclosure, on a publicly-traded company has always been difficult given restrictions that prevent insider trading. Such financial inquiry restrictions, however, do not apply to credit managers, whose job is to assess a company’s financial health, whether or not the company is public or private. Simply put, credit managers may legally acquire this sensitive information and act in the best interest of their company. This is an extremely important way to understand how financially healthy a company is as a counterparty or investment.

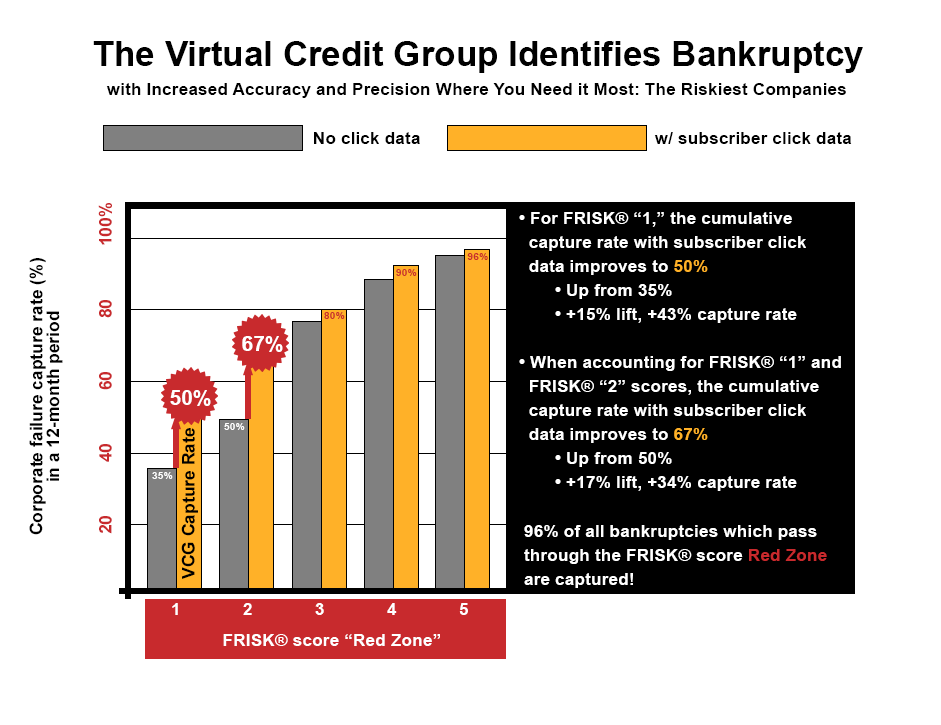

Leveraging sentiments among credit managers to enable a powerful predictive element strengthens the CreditRiskMonitor FRISK® score, which is 96% accurate in predicting public company bankruptcy risk within a 12-month period.

Calculated Movement

Credit managers access deeper levels of financial information on our site in several scenarios:

- When bringing on a new customer or supplier,

- When compiling information for annual update reports and

- When a company or supplier is showing signs of financial distress.

Subscribers follow a distinct, trackable click pattern when assessing information on companies that signal concern about financial distress. When enough users start examining the same companies in the same way over the same time period, our system recognizes the trend. Thus, the activity is qualified and weighted into our FRISK® score.

The FRISK® score scale, which ranges from a “10” (best) to “1” (worst), isn’t standardized from one score to the next. For example, if one company is rated a “10” and another rated an “8,” bankruptcy risk doesn’t change much. However, once a company moves into the "red zone," which is the “5” to “1” portion of the scale, bankruptcy risk jumps exponentially from one score to the next.

The real world impact felt is dramatic. A company with a score of “1” is twice as likely to file for bankruptcy than a company with a score of “2.” This is where the crowdsourcing of credit managers plays an integral part in the FRISK® score, because it can move a score lower by up to two rungs on the 10-point scale. Ultimately, being able to differentiate between a “2” or a “1” on the scale can potentially go a long way in allowing a professional to save his company from catastrophic loss.

The Pros and Cons

CreditRiskMonitor's subscriber usage data is instrumental when used as a barometer for tracking at-risk companies. CreditRiskMonitor has been researching public company credit for almost 20 years and counts nearly 40% of the Fortune 1000 as customers, plus thousands of others worldwide. Their collective movement can provide an unprecedented level of insight that we’ve taken and harnessed into the FRISK® score.

Notably, this information is tracked and incorporated into the FRISK® score daily. It provides a timely view of what is taking place today, compared to the quarterly views provided by financial statements. And it isn't hampered by the committee approach used at ratings agencies, which slows down the process of making important downgrades. Simply put, if enough subscribers are concerned about a company, you should be as well. Where there’s smoke, there’s often fire.

Conversely, though beneficial and insightful, the pool of companies impacted by crowdsourcing is small. That's logical, however, since credit managers only do in-depth research on the relatively small number of counterparties that are increasingly showing signs of financial strain. So this crowdsourcing component isn’t available for the majority of the 56,000-plus active public companies covered worldwide by CreditRiskMonitor, with financial statement and other data. But when it's available, it's important. By definition, it is available on the businesses our users care about most.

The FRISK® score is designed in such a way that it can work with robust accuracy even without the crowdsourcing input. When the research activity of credit managers heats up, however, crowdsourcing adds material value to the score by highlighting the companies about which our subscribers are most concerned.