The recently failed merger attempt between Sprint Corporation (NYSE: S) and T-Mobile US, Inc. (NASDAQ: TMUS) and uncertainty surrounding the AT&T Inc. (NYSE: T) and Time Warner, Inc. (NYSE: TWX) combination have been top business news stories. These transactions reflect an industry that is trying to solidify market share and expand scale. Broadly speaking, the telecom service industry is experiencing headwinds driven by changes in both technology and customer preferences.

Due to increased competition from leading-edge internet companies, businesses with less attractive product solutions and price points are falling behind. Frontier Communications Corporation (NASDAQ: FTR) and Windstream Holdings, Inc. (NASDAQ: WIN), both of which chose to invest in landline assets, have focused on end markets that appear to be in structural decline.

CreditRiskMonitor's proprietary subscriber crowdsourcing recently highlighted these two companies as exposing counterparties to increasing financial risk. CreditRiskMonitor has found that the specific subscriber research patterns of credit managers using its web service signals an increased concern among financial counterparties.

Credit managers have special access to information that is not publicly available, which makes these aggregate research patterns a powerful warning signal. Obtaining financial insight, prior to actual disclosure, on a publicly-traded company has always been difficult, given restrictions that prevent insider trading. Such financial inquiry restrictions, however, do not apply to credit managers, whose job is to assess a company’s financial health, whether or not the company is public or private. This is an extremely important – and legal – way to understand how reliable a company truly is as a partner, supplier, customer or investment.

Our organization has been researching public company credit for almost 20 years and counts more than 35% of the Fortune 1000 as customers, plus thousands of other credit managers worldwide. Their collective movement can provide an unprecedented level of insight that we’ve taken and harnessed into the FRISK® score.

The FRISK® scores of Frontier and Windstream have both been negatively impacted by recent subscriber activity. We suggest that all financial counterparties should stay alert to the increasing risks here.

Hanging Up?

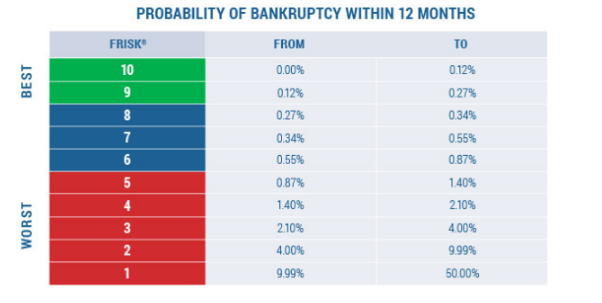

The FRISK® score achieves a 96% accuracy rate for forecasting public company financial distress over the course of the following 12 months. The FRISK® scale ranges from "1" (worst) to "10" (best), where every incremental step down represents a material increase in financial risk. For example, a score deteriorating from a "10" to an "8" is much less troubling than a drop from "3" to "1." The probability of bankruptcy is displayed in the score ranges below:

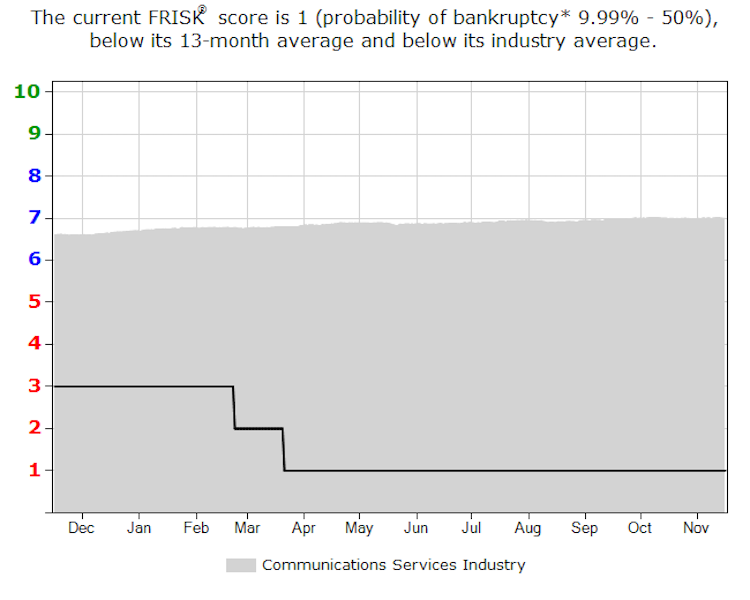

Frontier Communications' FRISK® score declined from a "3" to a "1" over the last 12 months, so the probability range balloons from 2.10 – 4% to 9.99 – 50%. The primary factors driving the drop to the worst possible FRISK® score of "1" include:

- High stock price volatility and a steeply negative market capitalization return; in November 2017 liabilities to market capitalization reached 39 times.

- Credit agencies have held the company's rating at "B," which corresponds to a highly speculative bond rating.

- All four Z-Score ratios have declined over the last four quarters; in particular working capital to total assets and retained earnings to total assets are negative.

- Subscriber crowdsourcing sent a negative signal based on research patterns that started in early 2017.

Frontier Communications is working hard to stabilize performance but consumer and commercial sales are eroding. In the third quarter, net sales declined approximately 11% on a year-over-year basis. Given the intensely competitive environment and the company’s large debt load, risk managers should watch for potential default risk.

Kicking the Can Down the Road

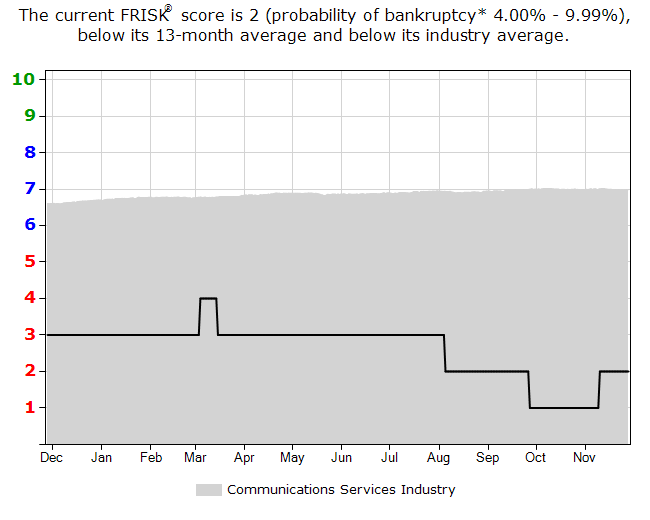

Windstream Holdings stands deep in the FRISK® “red zone” with a current score of “2.” Core data components are signaling heightened risk, which include:

- Moderate-high stock price volatility and a negative market cap return, as well as a liability to market cap ratio of 28 times.

- Standard & Poor’s holds the company at a “B,” a rating which falls into the "junk" category.

- The ratios of EBIT-to-total assets and total equity-to-total liabilities are weak. In addition, working capital to total assets and retained earnings to total assets have been negative.

- Subscriber crowdsourcing sent a negative signal starting in September 2017.

Windstream Holdings recently initiated a debt exchange offer, principally looking to refinance its closest maturities. Debt holders have been specifically concerned about the company’s cash flow generation leading up to these 2020 and 2021 maturities. The timeline regarding the proposed debt exchange has been extended until late December, but pushing out these maturity dates may only be a temporary fix. The FRISK® score of “2” clearly underscores the elevated risk involved in this situation.

Bottom Line

Frontier and Windstream have reported poor customer retention and experienced pricing weakness over the last few years, resulting in earnings weakness. As their FRISK® scores suggest, these companies have a material amount of credit risk embedded in their highly leveraged capital structures. If either name is unable to generate sufficient cash flow, unsecured creditors could soon experience a world of hurt. The most telling sign is the concern exhibited through our proprietary subscriber crowdsourcing data. If you do business with either of these companies, more stringent review and analysis is necessary.