Company supply chains are impacted by vendor financial risk – and bankruptcy – more often than you may think. If it hasn’t happened to your company yet, then it may only be a matter of time before it does.

We know public company financial risk analysis is important and here’s proof: supply chains routinely spend more with public company vendors, suppliers, and third-parties than with private companies. Financially distressed vendors can often lead to a multitude of issues including: supply chain disruption, reputational damage, lost sales, and even financial loss. With debt in public companies soaring the world over as interest rates remain near record lows, there's no guarantee that important suppliers who pay their bills on time today will be able to do so tomorrow.

Supplier financial risk, and public company bankruptcy, is going to accelerate in the years ahead. According to the projection of the Federal Reserve of New York, the probability of an economic recession is the highest it’s been in over a decade.

Recent History

Several hundred public companies have filed for bankruptcy in just the last few years, many involving multi-billion dollar enterprises. Four well-known international operators that caused widespread challenges for their commercial counterparties are shown in the chart below:

Bankruptcy Filing | Company | Industry | Total Assets (in U.S. Dollars) |

2016 | Hanjin Shipping Company Ltd. | Transportation | $5.6 billion |

2017 | Westinghouse Electric Company LLC | Construction | $1-10 billion |

2018 | Carillion plc | Construction | $3.7 billion |

2019 | Weatherford International plc | Oil & Gas Services | $6.4 billion |

Just between these service providers, company supply chains had to deal with major time delays and/or quality issues. They even had to worry about whether each respective business would remain solvent. By the end, Hanjin Shipping and Carillion plc were liquidated in bankruptcy, Westinghouse Electric was bought in a bankruptcy auction, and Weatherford International plc is still in the process of its bankruptcy restructuring.

Clearly, supplier financial risk creates problems that require a tremendous amount of time, effort, and capital to work through effectively. Don’t let it happen to your company.

Protect Your Supply Chain

Some of the leading company supply chains reflect on specific questions in order to proactively eliminate disruption, including:

- Are you concerned about your vendors' financial condition?

- What is your supply chain's financial risk distribution?

- How much of your spend is allocated between public and private companies?

- Do these company types require different methods of scoring and analysis?

- Which of your suppliers are on the cusp of shutting down?

- What about the credit risk of suppliers to your suppliers?

CreditRiskMonitor will gather all of these companies into one portfolio so you can effectively monitor the financial health of your supply chain. CreditRiskMonitor’s coverage spans 30+ million companies, including all public companies and millions of privates worldwide.

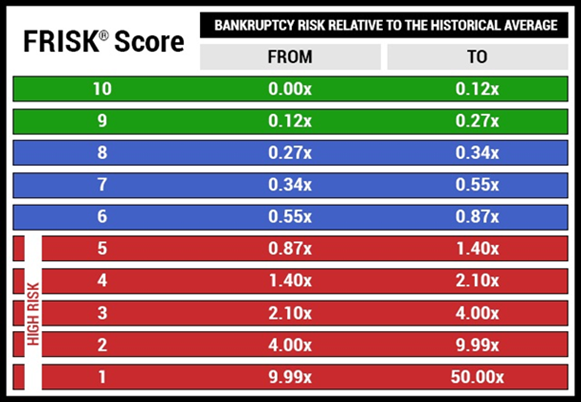

Our proprietary FRISK® score predicts public company financial risk with 96% accuracy across all industries. This credit model is updated every day and uses a variety of high-quality data sources to proactively monitor the financial health of public companies.

The FRISK® score uses a “1” (most risky)-to-“10” (least risky) scale that allows our subscribers to categorize suppliers that are financially stable and financially distressed:

If your counterparty has a FRISK® score in the green or blue zone (between “10” and “6”), it is considered acceptable and has a low chance of bankruptcy over the next 12 months.

Conversely, if the given company has a FRISK® score in the “red zone” (between “1” and “5”), then it is considered financially distressed and should be monitored closely. Why? Nearly all public companies trend into the red zone classification before they file for bankruptcy (based on our research dating back nearly 20 years).

Bottom Line

Our subscribers are monitoring supplier financial risk and your company should, too. CreditRiskMonitor’s inventory of offerings is used by key financial decision makers from nearly 40% of the Fortune 1000. Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems. We believe that it is imperative to prepare now, before the next economic downturn.