Following record-breaking commercial bankruptcies in 2020, central banks worldwide intervened to accommodate credit markets and suppress borrowing rates to alleviate financing pressures on corporations. Consequentially, this policy is exacerbating the proliferation of “zombie companies,” or firms unable to service their interest expenses, which has been steadily growing since the Great Recession. Many more companies are on the cusp of falling into this rather ghastly, distressed category as well. About 28% of public companies reviewed in the U.S. and Canada reported interest coverage beneath 2x, a prevailing warning that counterparty risk is trending in unprecedented territory.

Sectoral Review

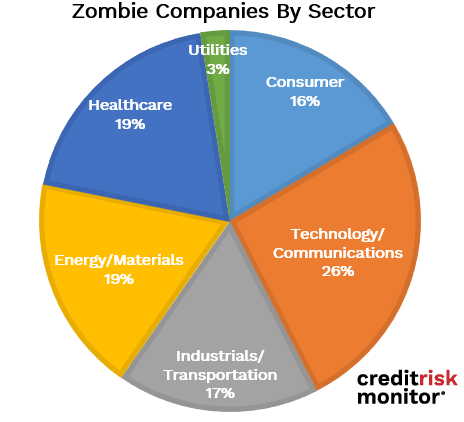

Zombie firms have other undesirable attributes beyond weak interest coverage, such as carrying high debt balances and generating anemic cash flows. There are also the typical factors of minimally sufficient net working capital to support operations (albeit only 25% of the 3,100 companies evaluated maintained a deficit) – and the terming out of maturities to alleviate debt rollover risk. These companies are fundamentally lingering, not thriving. According to our analysis, utilities were the sole sector that has broadly managed to sidestep the zombie-status category:

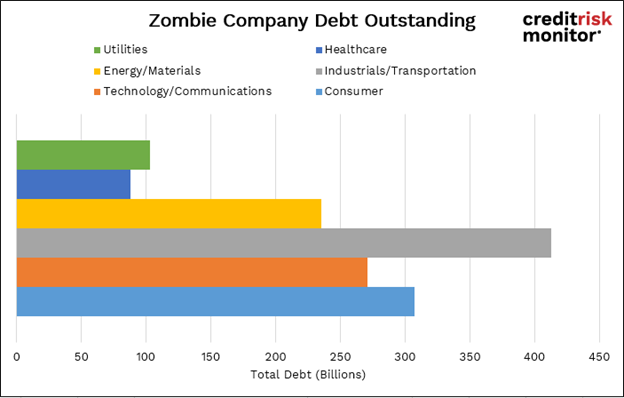

For FRISK®-scored companies with interest coverage falling beneath the 2x threshold, outstanding debt accumulated to more than $1.4 trillion. On the sector distribution, utilities and segments of healthcare companies were not required to tap debt markets as aggressively being less impacted by COVID-19, and many have since repaid redundant borrowings. The remaining industries, however, including industrials/transportation, consumer, technology/communications, and energy/materials, have layered on further to their amassed debt stack:

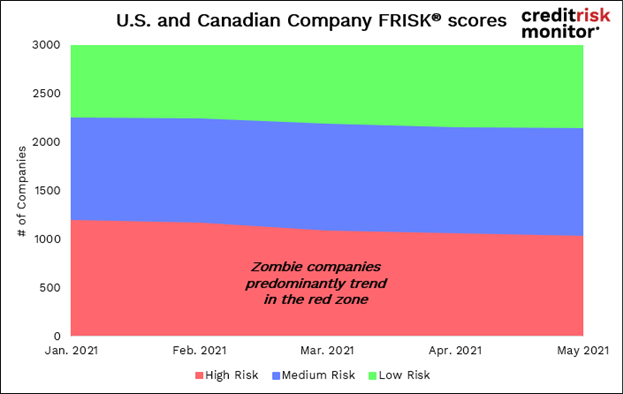

The FRISK® score blends stock market performance, financial statement ratios, bond agency ratings, and subscriber crowdsourcing to give professionals a daily read of how likely it is that any of their zombie counterparties (i.e., customer, supplier, vendor, third-party, competitor, etc.) will file for bankruptcy.

The FRISK® score categorizes highly distressed firms uniquely well by pinpointing those with the highest risk of bankruptcy in a subsequent 12-month period. Pertaining to captures, this subscriber crowdsourcing data stream helps target zombie companies by assessing the research patterns of senior risk officers who control working capital financing. Given zombie firms have limited or nonexistent loanable collateral, trade payables serve as one of the most important credit levers that must be managed to uphold liquidity. Subscriber crowdsourcing will provide an indication of whether professionals are concerned, and thereby offers vital insight into incremental changes in bankruptcy risk.

“Crowdsourced usage behavior identifies the shift in aggregate sentiment among the issuers of trade credit and therefore can be a game-changer in the detection of distressed, zombie companies. The trade credit market is roughly three times the size of bank loans and approximately 25% the size of the corporate debt in the U.S., so diminished access to this interest-free financing is the equivalent of the music stopping in today’s game of financial musical chairs.”

-- Michael Flum, CreditRiskMonitor President & COO

If inventory financing is turned off, companies are then forced to address these working capital needs with alternatives sources of cash, which are expensive or rarely available to highly distress companies. Take for example $50 million in payables being shifted to cash on delivery by its suppliers; that company will now need to seek out a loan or note to bridge its cash flow gap – though not all companies are so lucky.

In 2021, subscriber crowdsourcing trends signaled heightened risk in several industries, including the troubled categories of coal, motion pictures, and personal and household products, among others. Factoring in this real-time insight into the FRISK® score gives professionals the ability to make more informed judgements and decisions on their counterparties – or the next zombie companies to go bankrupt.

Bottom Line

Zombie companies, although continuing to issue more debt via leveraged loans and junk bonds, only survive so long as the credit environment is persistently relaxed and inflation stays low. Credit markets can close at a moment’s notice, and our chief concern is that the next fallout will be much worse than the last – whether that unforeseen event occurs next quarter or next year, risk management teams should be preparing for it now. Contact us to learn more about the growing zombie debt bubble and how our workflow integration solutions will detect those next to falter.