CreditRiskMonitor® published a High Risk Report on Tupperware Brands Corporation on Mar. 30, 2023. Over the past year, perhaps the most iconic name in food storage has exhibited telltale signs of increasing bankruptcy risk. Our patented FRISK® score has indicated extreme stress within Tupperware Brands; it’s now tipped off our subscriber base for more than a year while, simultaneously, other popular financial and payment risk models have yet to signal any trouble at all.

This article will provide five quick and vital facts about Tupperware Brands and what current CreditRiskMonitor subscribers - and prospective clients – can do to better protect their portfolio by signing up for a no-cost product demo.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. Best Preserving of Your Portfolio Starts with the FRISK® Score

Tupperware Brands continues to pay counterparties in a timely fashion, as highlighted by high marks when viewing the Days Beyond Terms (DBT) Index, a measure similar to Dun & Bradstreet’s PAYDEX® Score. The financial statement-driven Altman Z’’-Score has also been indicating robust financial strength. While these models are commonly used by risk professionals, both are proving unreliable in the case of this mammoth corporation.

The FRISK® score - which predicts bankruptcy with a forward 12-month outlook - for Tupperware Brands has fallen from "5" in April of 2022 down to a "1," the highest risk classification. Subscribers with the company in their portfolios received email notifications outlining the FRISK® score’s decline over time. A "1" on the 1 (highest risk)-to-10 (lowest risk) range indicates 10-to-50x higher bankruptcy risk when compared to the average public company.

The visual above makes it plain that our FRISK® score reveals bankruptcy risk while the DBT Index and Z"-Scores failed to do so. For context, the FRISK® score leverages four high-quality data components, including:

- stock market performance,

- credit agency ratings from Moody’s, Fitch, and DBRS Morningstar,

- financial ratios, like those found in the Altman Z’’-Score, and

- CreditRiskMonitor subscriber click sentiment data, a.k.a. crowdsourcing

Often, single-factor models like the DBT Index and Z’’-Score miss the mark, especially when applied to evaluating risk within public companies and their capacity to borrow and take on debt. This blend of data sources in the FRISK® score precisely categorizes 96% of public companies as high risk prior to filing bankruptcy. Simply put, a red-shaded FRISK® score is a flashing neon sign, informing that you must pay stricter attention and take action to adjust risk exposure.

2. Bad News Keeps Getting Worse

One of the key features of the CreditRiskMonitor service is the daily email news alerts that subscribers receive, which provide important updates on companies in their portfolios. For Tupperware Brands, those recent updates have included:

- notice of the delayed filing of the company's annual report with the SEC,

- the potential restatements of previous financial statements,

- credit agreement amendments,

- an SEC investigation into the company's accounting practices,

- a delisting warning from the New York Stock Exchange, and

- the recent hiring of advisors to "help improve its financial structure" and resolve "doubts regarding its ability to continue as a going concern"

All of these notifications, even when considered individually, are quite negative to both creditors and suppliers. Together? They tell a horror story – one that contextualizes Tupperware Brands’ steep, sharp spiral. Having been warned well in advance of the company's increasing risk profile, however, CreditRiskMonitor subscribers have been well informed. In fact, as the FRISK® score declined and the bad news piled up, subscribers would have known to conduct further research and analysis, as well as consider risk mitigation procedures depending on their relationship with the business.

3. Financials Are Breaking Down

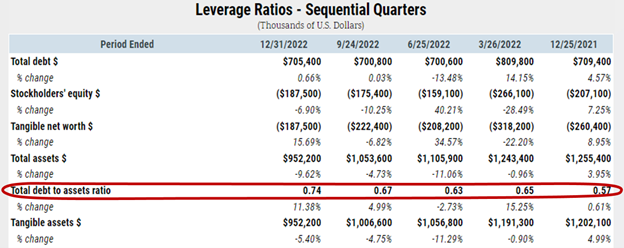

Delayed financials and restatements are always a concern, but the financial trends are still telling. Tupperware Brands' sales have been heading generally lower for the past five years, yet they more notably fell off between FY21 and FY22. Net income has been particularly weak in three of the past five years, with 2022 dipping into the red. Free cash flow also turned sharply negative in 2022, extending a multi-year decline. The company didn't cover its interest costs in 2022 either. Turning to leverage, Tupperware Brands’ total debt-to-assets ratio has increased materially over the past year, rising from 57% to 74%.

The overall deterioration in financial health is clearly reflected in the financial statement spreads offered in the CreditRiskMonitor service, which provides annual, sequential quarter, year-over-year, and trailing 12-month comparisons.

4. Management Warns of the Worsening Trends

Another key factor to examine is a company's Liquidity Management Discussion and Analysis (MD&A), which is easily accessible in the CreditRiskMonitor service. Companies are legally obliged to explain any material risks in this portion of their SEC filings. Tupperware Brands is no exception, as the MD&A highlighted a material decline in the company's cash balance and that earnings volatility might lead to noncompliance with debt covenants.

"If the Company is unable to access future borrowings or is required to pay amounts due under its Credit Agreement prior to their normal maturity dates, this would have a material impact to its financial position. Accordingly, the Company believes that there is substantial doubt about its ability to continue as a going concern for the twelve-month period following the date of this filing."

The risk was material enough that management had to issue a going concern warning. This disclosure was available in the company's September 2022 filing, though the MD&A also highlighted that the company was working with lenders on a solution either via a waiver or term amendments. A going concern warning is a material red flag that requires immediate attention. The company issued another going concern warning in a news release that it hired advisors on Apr. 7, 2023.

5. Worrying Employee Changes

As is so often the case with financially troubled companies, Tupperware Brands has seen material changes in its highest ranks over the past year or so. The list includes the hiring of a new Chief Financial Officer, the termination of the Chief Operating Officer, the termination of the President, Commercial position, and an appointment of a Chief Commercial Officer position.

Although personnel changes are not uncommon at any company, they take on more importance for financially distressed companies. It can signal that the board is making changes because it is worried about the company's direction and/or that senior employees are looking to exit the company before the business collapses. Notably, the direct sales model used by Tupperware seems increasingly outdated in today's digital, and globally integrated, economy. Regardless of why employee turnover is happening, when combined with the other factors noted above, it should worry counterparties.

Bottom Line

The FRISK® score has been warning for more than a year that counterparties should be paying extra close attention, even as other risk models fail to highlight the risk evident with Tupperware Brands. Contact CreditRiskMonitor today if you want to get ahead of looming bankruptcies in your portfolio.