The senior housing industry reported a significant share of the coronavirus illness cases, causing a collapse in occupancy. A considerable population decline in assisted living facilities could deliver a slew of corporate bankruptcies in the coming year.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

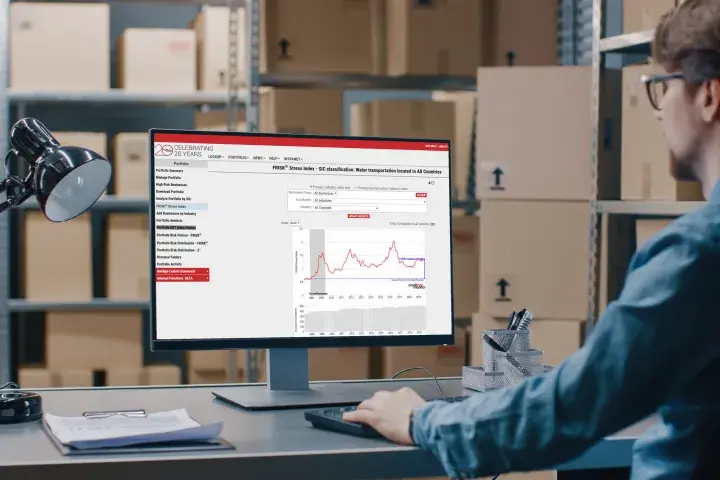

CreditRiskMonitor subscribers were the first to see the danger in now-bankrupt propane giant Ferrellgas Partners. The keys to successful risk evaluation were regularly keeping a keen eye upon the FRISK® score and not being swayed by payment data.

CreditRiskMonitor automates the monitoring of financial stress in public and private companies and leverages the knowledge of the crowd to make sure that busy professionals get a "tap on the shoulder" when it is time to act.

Ferrellgas Partners, L.P. is a good example of what to look for as a financial counterparty spirals toward bankruptcy, seeking out court protections.

Keep your brains about you: if it looks like a zombie, acts like a zombie, and reports like a zombie, it is probably a zombie.

Windstream Holdings, Inc.'s FRISK® score is signaling financial stress, and subscriber crowdsourcing specifically shows that risk professionals have been on high alert for nearly a year.

Apparel retailers have required significant adjustments to handle their financial leverage and operating lease commitments. Brooks Brothers and Tailored Brands, in particular, fell prey to slowing demand for professional business attire, a trend which was accelerated by the coronavirus pandemic.

Some big names filed for bankruptcy in 2017, and they all had a few key common indicators. Read our analysis and findings here.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.