Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Ferrellgas Partners, L.P. is a good example of what to look for as a financial counterparty spirals toward bankruptcy, seeking out court protections.

Some big names filed for bankruptcy in 2017, and they all had a few key common indicators. Read our analysis and findings here.

CreditRiskMonitor offers up five quick and important facts that you need to know about Peabody Energy Corporation right now to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

For J. C. Penney Company, Inc., CreditRiskMonitor's proprietary subscriber crowdsourcing is indicating negative sentiment and matches the high-risk assessment of the retail giant provided by the FRISK® score.

The fall of car rental giant Hertz Global Holdings, Inc. proves the point that the health of an entire supply chain, from raw material harvesting to finished products, is critical to understand relative to assessing bankruptcy risk potential.

CreditRiskMonitor’s FRISK® Stress Index shows elevated financial risk within the global steel manufacturing industry, including big-time players in Schmolz + Bickenbach and ArcelorMittal.

With cracks already starting to show in the trucking industry and CFOs worrying that economic conditions are primed to decline, the time to prepare is now.

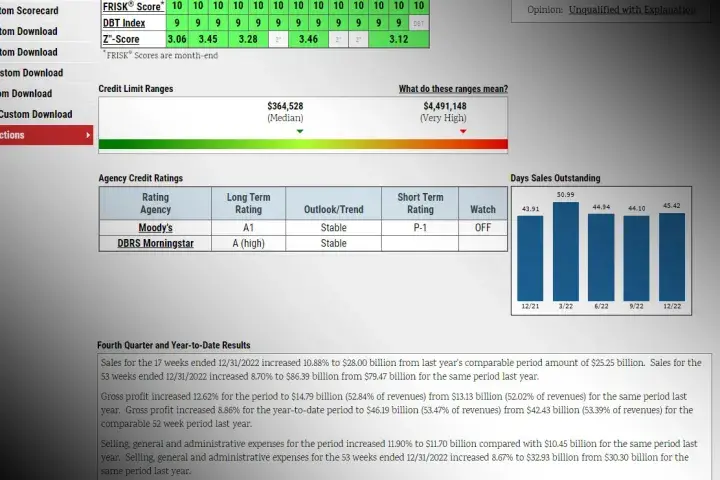

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.