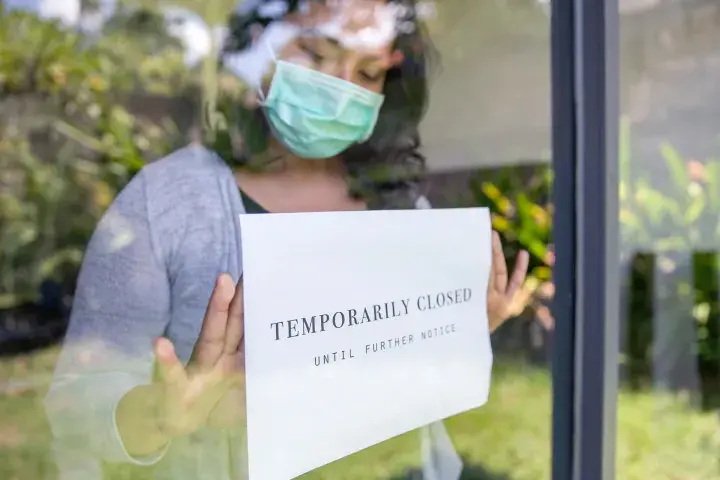

Australia’s previously stable economy is exhibiting an increase in risk due to a number of factors like a retail sales decline and slowing in its overheated housing market.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The Russia/Ukraine conflict has pushed oil prices above $100 USD per barrel, further impacting the profitability, or lack thereof, of the airline industry. We identify airlines most at risk of bankruptcy.

CreditRiskMonitor® offers up five quick and important facts that you need to know about Tupperware Brands Corporation to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

In the wake of Russia's invasion of Ukraine nearly one year ago, we note how companies in 2023 must implement sound sourcing strategies that account for sanctions, country, and financial risk to mitigate future disruptions.

The harsh downturn in several end markets has resulted in overcapacity in key industrial commodity markets, causing base metal prices to break materially lower. We note where bankruptcy is most probable.

CreditRiskMonitor® offers up five quick and important facts that you needed to know about now-bankrupt Rite Aid Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.

CreditRiskMonitor describes some of the key themes of the Bed Bath & Beyond Bankruptcy Case Study and some of the "rhymes" you'll find with past and future bankruptcy situations.

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.