The median U.S. supplier has reduced capital expenditures into property, plant, and equipment and has increased their total debt-to-asset burden in the last two years. Such action creates pitfalls in supply chains, especially in the age of COVID-19.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

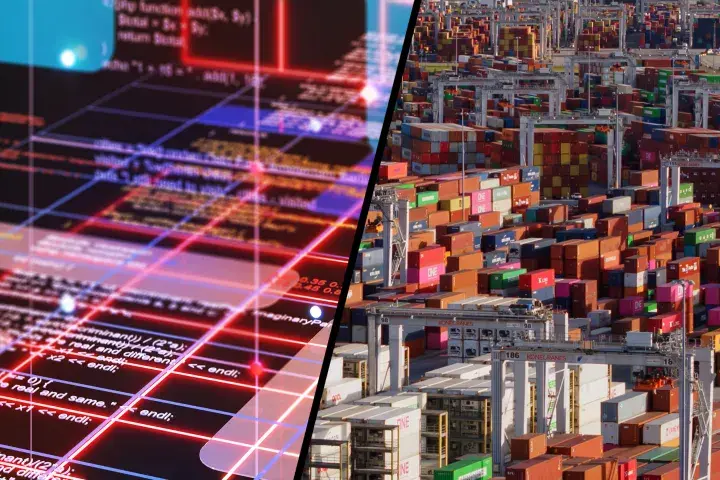

Supplier financial risk in China calls for increased scrutiny. Now is the time to proactively leverage tools like the FRISK® score to conduct objective audits of your prospective and existing suppliers as supply chains restructure.

Establishing a culture of strong supply chain oversight is vital during a global pandemic, and CreditRiskMonitor can provide you all the tools necessary to be successful in this endeavor.

For Apple, providing capital support to its supply chain is an option, but for most companies bailing out critical suppliers is not financially feasible, let alone an option on the table. Is your supply chain secure?

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.

Keep your brains about you: if it looks like a zombie, acts like a zombie, and reports like a zombie, it is probably a zombie.

Risk professionals like yourself are preparing for another economic downturn and our API will enhance your workflows. This scalable data provides automation for supply chain analysis, reviewing prospective vendors, and RFP processes.

Companies have been ramping up efforts in nearshoring their purchased goods from Mexico and Canada while keeping other regions steady. This trend indicates supply chains are focused on dual sourcing and seeking alternative suppliers.

The FRISK® score enables procurement and supply chain professionals to monitor the financial risk of their suppliers, vendors, and third parties quickly and efficiently.