Supply Chain Solutions

Why engage suppliers who aren't financially stable?

Our SupplyChainMonitor™ solution provides interactive tools to dynamically monitor and manage risk within your supply chain.

See it in Action

Sign up for a free demo of the full SupplyChainMonitor™ solution.

Broad Coverage

30,000,000We cover more than 30,000,000 businesses worldwide, perfect for identifying alternative suppliers when needed.

Rapid Efficiency

35-40%Typical reduction in time to evaluate prospective suppliers, keeping you freed up to solve problems elsewhere.

Taking time to vet a prospective supplier on items like ESG and Cyber Security is a waste if they aren't financially viable first. Ensure that your base requirements for financial stability are met before investing time and effort in more detailed assessments. Financially distressed suppliers consistently provide lower quality products/services, under invest in maintenance and R&D, and are prone to disruptions.

Don't fall victim to such failures. Get the help you need with SupplyChainMonitor™.

Expansive functionality to help you understand your supply chain's exposure to global and regional risk.

Easy-to-use filtering and built-in views that offer concise dashboards with drill-down capabilities to examine counterparty risk across categories including geography, industry, and risk level, plus subscriber-provided metadata classes such as criticality and direct/indirect

Map functions to easily view supplier locations on a world map, which supports real-time weather and natural disaster event overlays

Macro-level risk information on 180 countries across 10 risk categories powered by the Economist Intelligence Unit to assist in sourcing strategy when examining geopolitical, legal, labor, tax, and security risks

Enhanced alerting on material news, weather, power outages, and other risk alerts and monitoring can be configured as immediate or daily digest push notifications on individual or groups of business and/or geographic areas

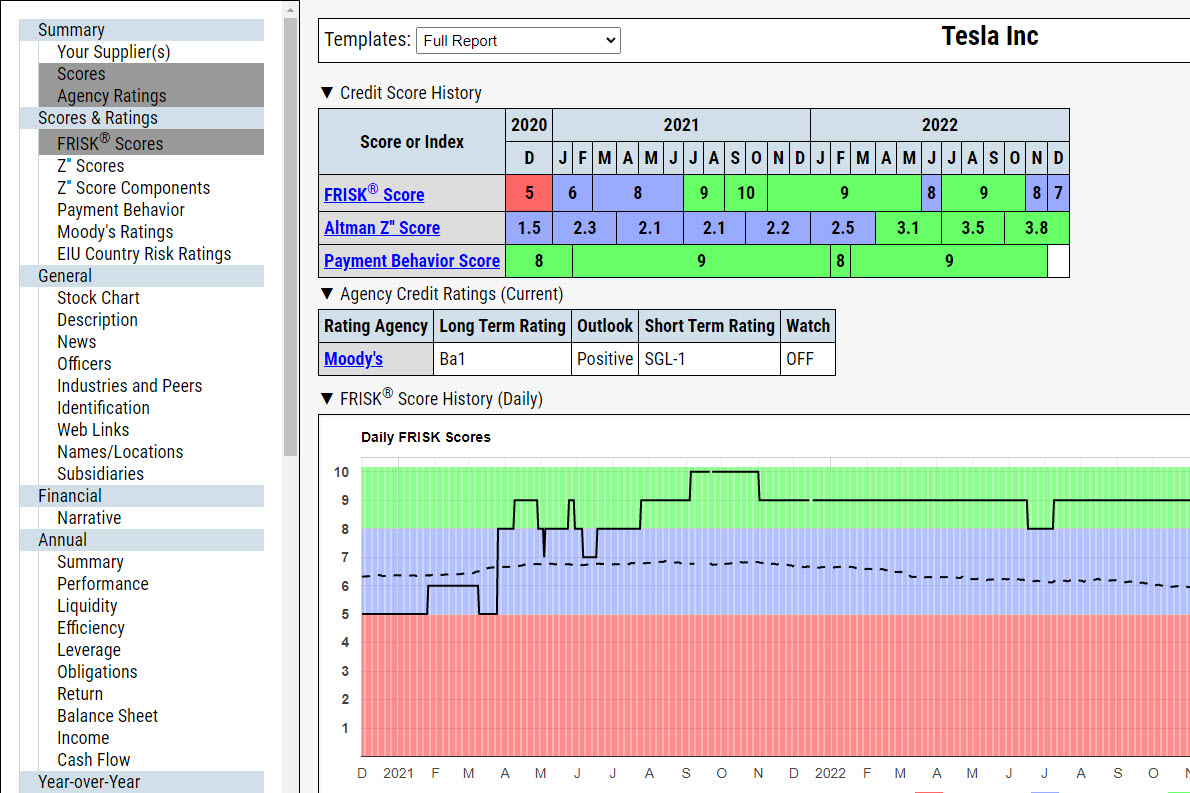

Fully customizable business reports providing rich financial insights and charts, our industry-leading 96%-accurate FRISK® Score, analyst-informed questions for at-risk counterparties, bond agency ratings, over 40 unique financial ratios, and much more

Records on over 30,000,000+ businesses worldwide with predictive risk scores on 5,000,000+ businesses and Tier-2 payment data on four million businesses, SupplyChainMonitor™ provides actionable insights for procurement risk management on 80%+ of global dollars-at-risk

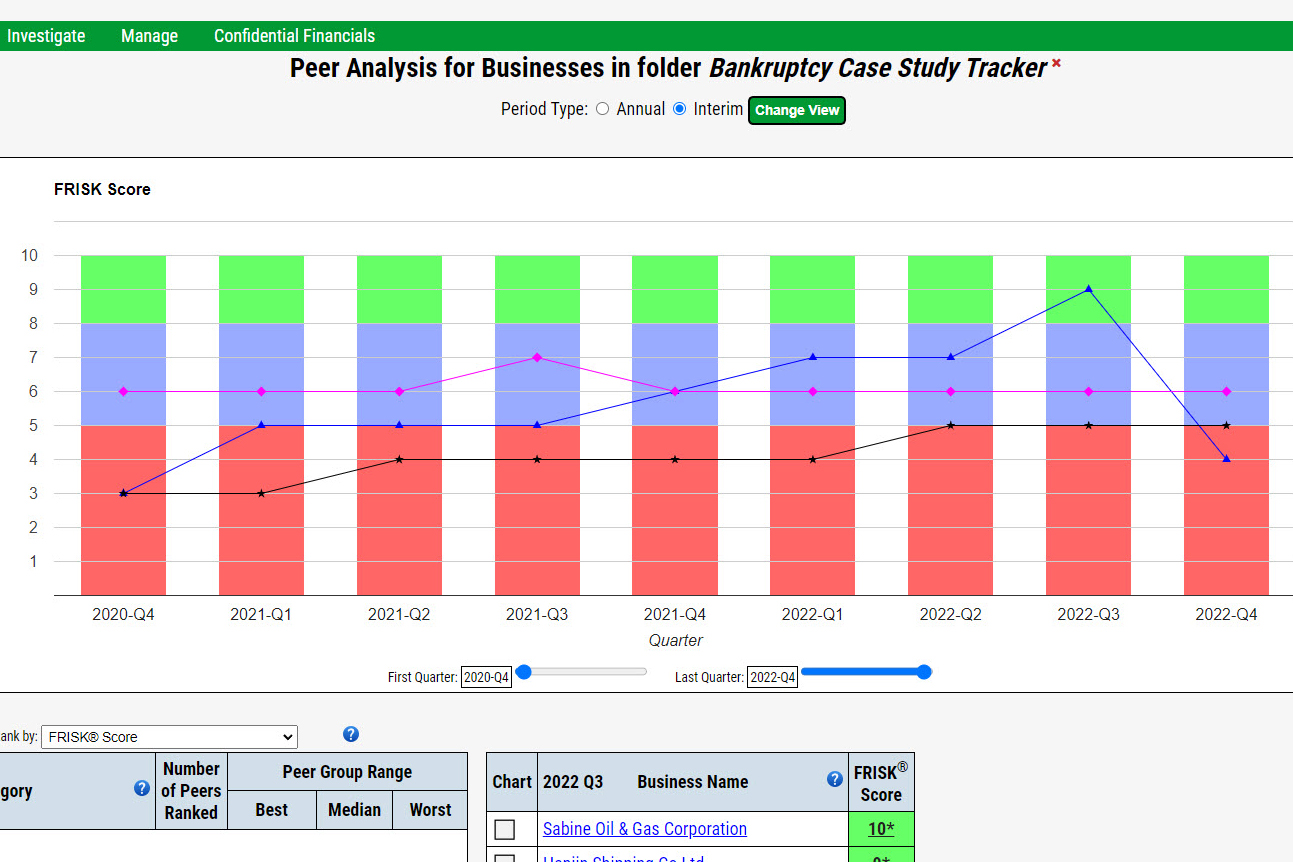

Expert peer analysis tools allow comparisons of up to five companies over time across financial ratios and risk scores, simplifying bid reviews and alternative source investigations

Winning strategies in procurement risk monitoring and avoidance

Alternative Supplier Discovery

Understand the financial stability of your suppliers - and find alternative suppliers quickly.

SupplyChainMonitor™ provides access to millions of FRISK® and PAYCE® Scores to evaluate the financial risk level of your strategic counterparties. A single weak link – or bankruptcy – can cripple your entire supply chain.

RFP Vendor Comparison

Rapidly evaluate prospective vendors for financial stability and geopolitical risk

With SupplyChainMonitor™, you can see a snapshot of a prospective vendor's financial stability within minutes. Access risk scores and financials, as well as compare vendors against their peers - potentially achieving huge savings in travel and personnel time.

Strategic Planning for Global Markets

Understand your supply chain's exposure to global and regional risk

In a post-pandemic world, can you count on certain regions to maintain strong supply chains? If a market like China is manipulating its currency and is largely shrouded in secrecy, should you consider nearshoring as a pivot? These are questions that we can help you answer when analyzing your supplier list.