Public company bankruptcies soared in 2020, and filings continue to roll in as fallout from COVID-19. Here are five of the most notable Chapter 11 cases we've seen so far in 2021, and another five companies we feel are in big-time danger.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The COVID-19 pandemic swiftly delivered hundreds of bankruptcy filings in 2020. Here in 2022, geopolitical tensions, supply chain challenges, and tightening credit conditions could lead to a similar devastating outcome.

Australia’s previously stable economy is exhibiting an increase in risk due to a number of factors like a retail sales decline and slowing in its overheated housing market.

For J. C. Penney Company, Inc., CreditRiskMonitor's proprietary subscriber crowdsourcing is indicating negative sentiment and matches the high-risk assessment of the retail giant provided by the FRISK® score.

A dormant debt powder keg ignited in 2023; as bankruptcies continue to explode in 2024, risk professionals must set into motion a multi-faceted approach to financial risk evaluation.

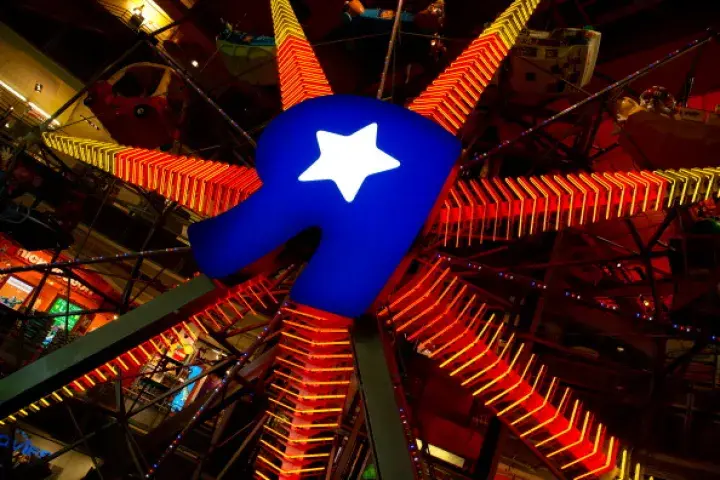

Toys “R” Us filed for bankruptcy right before the holiday season in 2017 as suppliers began to restrict access to trade credit, setting in motion a liquidity crunch.

Subscriber crowdsourcing data has highlighted J. C. Penney Company, Inc.’s bleak financial position, and users can affirm this through its low FRISK® score.

The start of 2018 has various Bon-Ton Stores, Inc. stakeholders on edge, as all await a judge's ruling on the retailer's recent bankruptcy.

CreditRiskMonitor offers up five quick and important facts that you need to know about Bed Bath & Beyond Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.