Credit professionals use CreditRiskMonitor®’s Trade Contributor Program to gain quality, real-time insights into their accounts receivable portfolio. We collect in excess of $2 trillion in trade data annually from our trade providers. After processing this data, we work with credit professionals to be more proactive and tactical with their accounts receivable to make healthier business decisions.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor’s FRISK® Stress Index shows elevated financial risk within the global steel manufacturing industry, including big-time players in Schmolz + Bickenbach and ArcelorMittal.

CreditRiskMonitor recently interviewed Patrick Spargur, an experienced commercial debt collections executive, and former credit manager, on the economic downturn and relevant credit industry best practices to use in this challenging environment.

It’s just not working out: the coronavirus pandemic is forcing the hand of financially weak American fitness operations to pursue bankruptcy, with many involving permanent location closures.

Two major U.S. pharmaceutical companies possess heightened bankruptcy risk largely due to lawsuits stemming from the opioid crisis. Our models are reflexive enough to give the most accurate forward-looking reads on financial risk when calamities strike.

Apparel retailers have required significant adjustments to handle their financial leverage and operating lease commitments. Brooks Brothers and Tailored Brands, in particular, fell prey to slowing demand for professional business attire, a trend which was accelerated by the coronavirus pandemic.

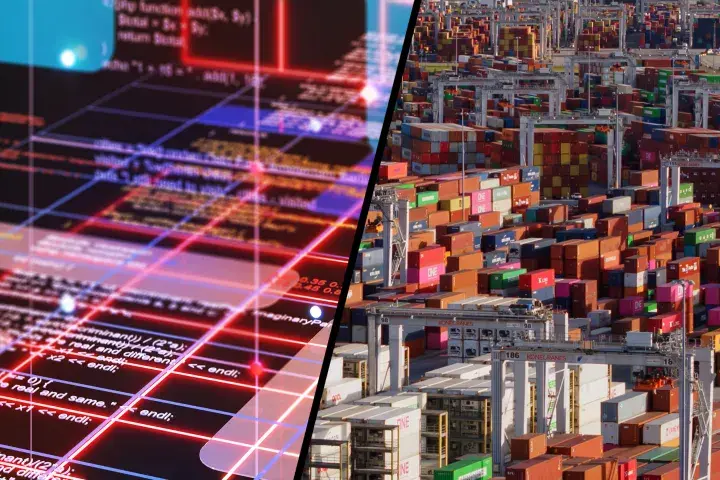

Armed with CreditRiskMonitor’s SupplyChainMonitor product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

What are the root causes of the failure of risk models to provide adequate warning? After nearly 25 years of company operation and observation, CreditRiskMonitor® has identified four common problems among competing risk models.

Risk professionals like yourself are preparing for another economic downturn and our API will enhance your workflows. This scalable data provides automation for supply chain analysis, reviewing prospective vendors, and RFP processes.