Argentina is using extraordinary measures to keep its economy afloat. As the peso declines, businesses that are heavily reliant on debt financing could be in trouble if problems persist.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Knowledge of how and when to react to a business defaulting is essential; cutting ties with a customer or supplier too soon could lead to a missed sales opportunity, while being too late can result in financial loss.

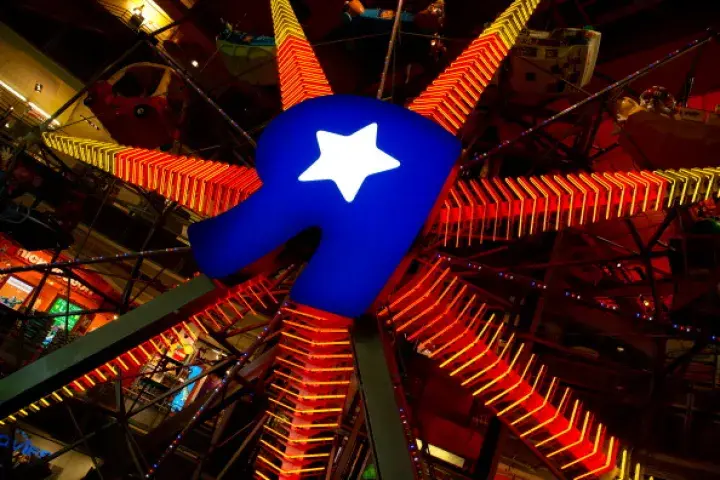

Toys “R” Us filed for bankruptcy right before the holiday season in 2017 as suppliers began to restrict access to trade credit, setting in motion a liquidity crunch.

Property development represents about 30% of China’s GDP. Ongoing defaults could eventually convert into bankruptcy filings that would shake up the industry - and subsequently rock markets in the West.

Two major U.S. pharmaceutical companies possess heightened bankruptcy risk largely due to lawsuits stemming from the opioid crisis. Our models are reflexive enough to give the most accurate forward-looking reads on financial risk when calamities strike.

CreditRiskMonitor offers up five quick and important facts that you needed to know about now-bankrupt Yellow Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

The median U.S. supplier has reduced capital expenditures into property, plant, and equipment and has increased their total debt-to-asset burden in the last two years. Such action creates pitfalls in supply chains, especially in the age of COVID-19.

Thermal coal seller Cloud Peak Energy, Inc. is under intense, increasing financial stress as highlighted by our proprietary FRISK® score.

We take a look at two companies occupying different spaces within the overall beverage industry – Reed's, Inc. and Monster Beverage Corporation – to see how they compare on financial risk.