Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Just like tariffs, supplier financial risk has become an important category to monitor by company procurement departments. If this isn't on your radar today, it should be.

Two major U.S. pharmaceutical companies possess heightened bankruptcy risk largely due to lawsuits stemming from the opioid crisis. Our models are reflexive enough to give the most accurate forward-looking reads on financial risk when calamities strike.

A contraction in credit is not something that might occur: It will happen at some point. Risk professionals dealing with the technology sector are better off preparing now, while economic conditions are still strong.

CreditRiskMonitor automates the monitoring of financial stress in public and private companies and leverages the knowledge of the crowd to make sure that busy professionals get a "tap on the shoulder" when it is time to act.

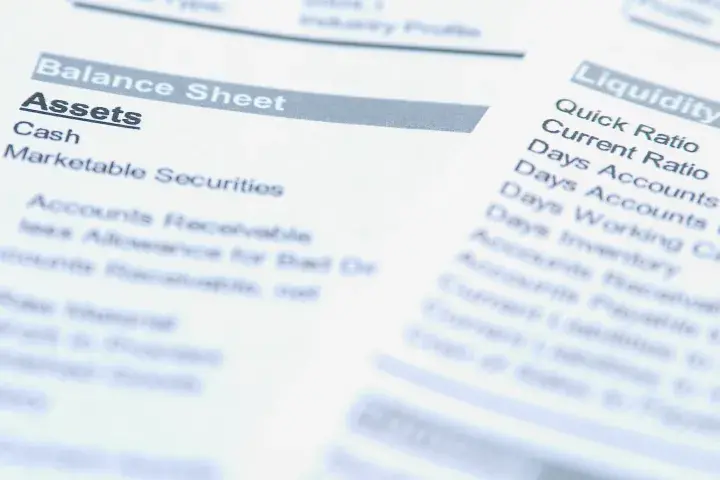

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how financial ratios play a role.

Public company bankruptcies soared in 2020, and filings continue to roll in as fallout from COVID-19. Here are five of the most notable Chapter 11 cases we've seen so far in 2021, and another five companies we feel are in big-time danger.

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.