Powered by crowdsourcing and deep neural network technology, CreditRiskMonitor® uses two proprietary scores – FRISK® and PAYCE® – to more accurately predict financial risk at public and private companies, respectively.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Stop the presses: U.S. printing mainstay Cenveo, Inc. met bankruptcy in early 2018. Our subscribers were well aware of Cenveo's troubles for more than a year, however, thanks to the FRISK® score and our crowdsourced behavioral data.

Department stores have been underperforming, with retailer J. C. Penney among the hardest hit by internet competition. This High Risk Report addresses the retailer's FRISK® score of "1", which signals an elevated degree of corporate financial distress.

German-based package printing company Heidelberger Druckmaschinen AG’s FRISK® score has sunk to a "1" in 2020. Could bankruptcy be in their near-term future?

Read in-depth how crowdsourcing the wisdom of our uniquely positioned subscribers has enabled a significant enhancement of the CreditRiskMonitor FRISK® score, more accurately predicting corporate financial stress.

Our subscribers who had global travel giant Thomas Cook Group plc in their portfolios as the company's debt soared and working capital eroded were provided ample time to sidestep financial risk thanks to the FRISK® score.

Adeptus Health recently filed for bankruptcy and creditors may have missed the early warning signs. Adeptus Health's FRISK® score, however, caught the trouble as it signaled increasing financial risk over the last twelve months. Even more concerning, there are several other operators in this space currently receiving a similar high-risk assessment.

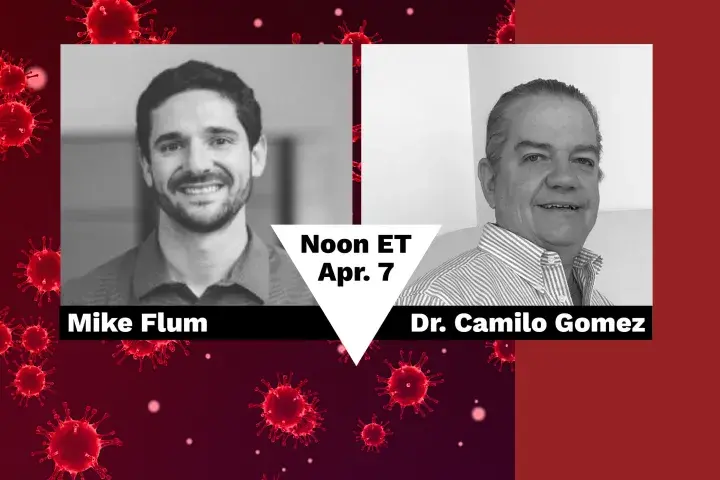

One Year In: The COVID-19 Pandemic Pushes Financial Risk to the Limit

Join CreditRiskMonitor's President & COO Michael Flum and Sr. VP of Data Science Dr. Camilo Gomez for a look back at the volatile year that was in 2020 and how the FRISK® score was instrumental in making financial risk evaluators aware of potential bankruptcies far earlier than by using other models.

Windstream Holdings, Inc., is trending in the high-risk FRISK® "red zone," which is, in part, a reflection of its cumbersome debt load. But that's not the only trouble spot for this telecom provider.