You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

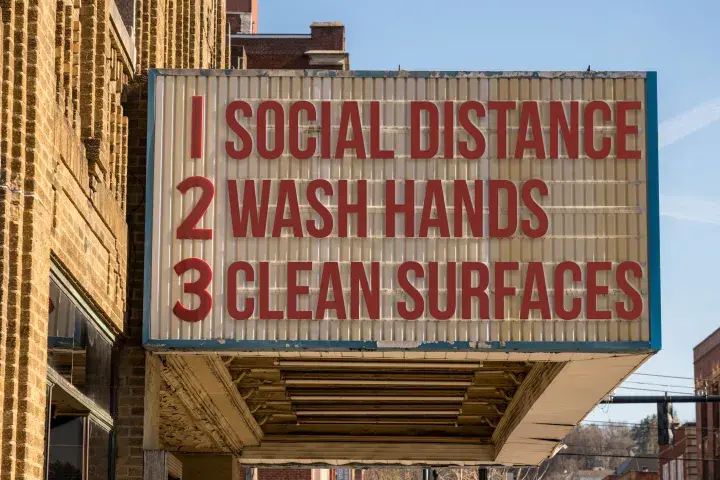

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

CreditRiskMonitor warned of the increased bankruptcy risk at newspaper owner McClatchy Company for more than a year before their Chapter 11 filing in February 2020. Yet McClatchy Company is not an isolated case and risk professionals should be monitoring other news provider outlets closely.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.

Subscriber crowdsourcing data has highlighted J. C. Penney Company, Inc.’s bleak financial position, and users can affirm this through its low FRISK® score.

Public and private companies need to be proactively evaluated in distinct, different ways by risk management professionals - fortunately, with the FRISK® score and PAYCE® score, CreditRiskMonitor has world-class solutions for both subportfolios.

With cracks already starting to show in the trucking industry and CFOs worrying that economic conditions are primed to decline, the time to prepare is now.

Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.

Property development represents about 30% of China’s GDP. Ongoing defaults could eventually convert into bankruptcy filings that would shake up the industry - and subsequently rock markets in the West.