The offshore oil and gas market remains widely depressed. Troubled outfit Hornbeck Offshore Services, Inc. has fallen to a FRISK® score of “1,” which indicates severe financial distress.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

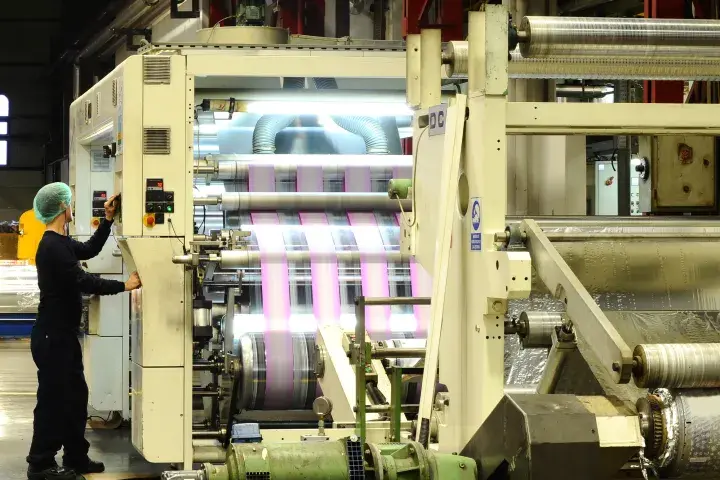

A supplier network fraying at the edges can eventually break down into a full-blown disruptive crisis. With global debt soaring, daily bankruptcy risk evaluation is a must.

Deep cracks are surfacing in global corporate debt markets. The timing of corporate bankruptcies is always difficult to predict, yet FRISK® score trends show that the odds of a bankruptcy wave have measurably increased.

Optimal assessment of public company bankruptcy risk requires the balanced, holistic analysis provided by the FRISK® score.

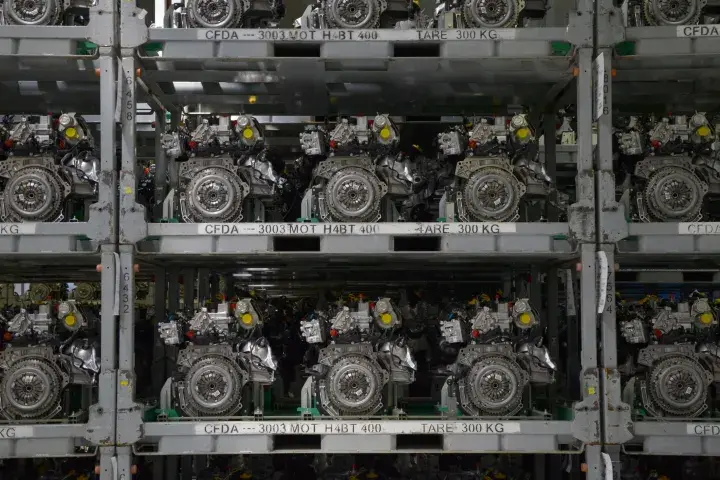

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

In 2019, nearly half of the 230 publicly traded Chinese construction companies we cover are financially distressed. If you have exposure to China’s real estate market, we urge you to monitor closely the financial risk potential of your commercial counterparties.

Stage Stores Inc. is nearly 10 times more likely to face bankruptcy by this time next summer than the typical public company.

D&B’s "Bankruptcy: Why the Surprise?" whitepaper shows that their popular PAYDEX® score misleads trade creditors on public company bankruptcy risk.