Nearly 30 percent of Australia's public companies in our CreditRiskMonitor global directory are at a FRISK® score which indicates an elevated level of bankruptcy risk in 2018. Supply chain professionals must know that even in a strong Australian economy, risk exists in plenty of industries.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Risk of financial failure in South America is higher than it was during the Great Recession a decade ago. We scouted more than 1,500 public companies to find the riskiest public companies on the continent.

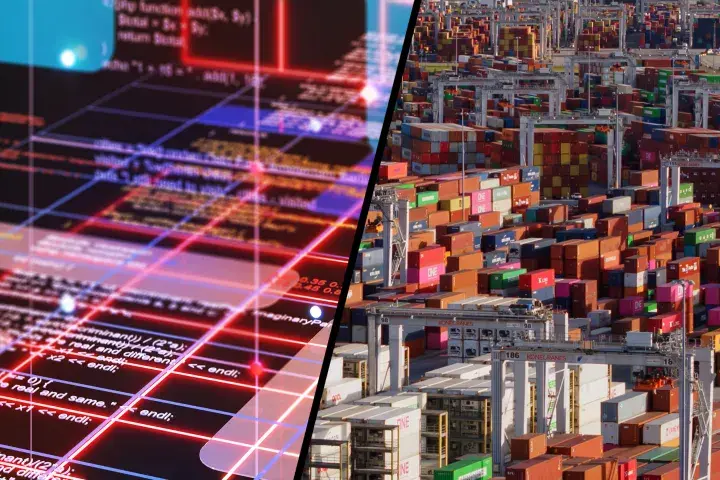

Armed with CreditRiskMonitor’s SupplyChainMonitor product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

Risk professionals like yourself are preparing for another economic downturn and our API will enhance your workflows. This scalable data provides automation for supply chain analysis, reviewing prospective vendors, and RFP processes.

Just like tariffs, supplier financial risk has become an important category to monitor by company procurement departments. If this isn't on your radar today, it should be.

The FRISK® score enables procurement and supply chain professionals to monitor the financial risk of their suppliers, vendors, and third parties quickly and efficiently.

CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) is pleased to announce that its SupplyChainMonitor™ solution has been recognized as a top procurement technology in the Spend Matters Fall 2024 SolutionMap.

CreditRiskMonitor was honored by SpendMatters as one of "50 Providers to Watch" in procurement for 2018, among top companies offering the latest and most innovative solutions in the industry.

Financial stability is the bedrock of supply continuity. In collaboration with The Hackett Group, this brochure highlights how procurement professionals can transcend the current volatile atmosphere by leveraging predictive analytics to streamline operations and eliminate unnecessary exposure.